The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Crunch on liquidity costs

As bid-ask spreads begin to widen on both sides of the Atlantic, buy-side credit traders need to reassess how to best manage the crunch...

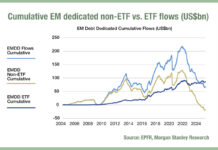

Inflows to EM debt beta funds could change trading patterns

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while...

BGC CEO to divest ownership if appointed US Secretary of Commerce

Howard Lutnick, CEO of interdealer broker, infrastructure and data provider, BGC Group, has said he would leave the business entirely if he is appointed...

Squeezing the bid-ask spread

Bid-ask spreads in the corporate bond space have continued to collapse in 2025, suggesting that liquidity costs are dramatically improving for buy-side traders.

Looking at...

Fixed Income Automation Surge: 60% of Credit Traders Now Use Robots

The electronification of fixed income markets is accelerating, driven by increased adoption of automated trading systems, with 60 per cent of credit market participants...

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

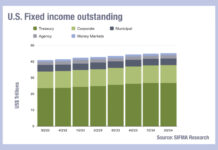

Money markets begin to tail off as rates fall

Reviewing the second quarter activity in primary markets and fund flows, we see the total notional outstanding in US fixed income totalled US$45.3 trillion,...

When not to use portfolio trading

Portfolio trading cannot please all of the people all of the time.

The success of portfolio trading (PT) as a protocol has taken bond markets...

IRS electronification: 20 years in the making

With the 20th anniversary of Tradeweb’s interest rate swaps (IRS) marketplace around the corner, the firm’s head of US institutional Rates, Bhas Nalabothula, looks...