Crunch on liquidity costs

As bid-ask spreads begin to widen on both sides of the Atlantic, buy-side credit traders need to reassess how to best manage the crunch...

Orderly sell-off despite Bund bid-ask spread blow out

Borrowing costs for the German government spiked after an announcement of increased expenditure for its military, triggering a sell-off in German government bonds (bunds)...

Squeezing the bid-ask spread

Bid-ask spreads in the corporate bond space have continued to collapse in 2025, suggesting that liquidity costs are dramatically improving for buy-side traders.

Looking at...

Is Europe being punished for slower e-trading adoption?

The liquidity shortfall, expected at the end of the year, is traditionally triggered by dealers’ reluctance to make markets when their risk positions are...

valantic FSA to develop web UI for Nasdaq Rates Trader

valantic FSA has agreed to develop Nasdaq Rates Trader, a new web-based user interface for Nasdaq’s Nordic and Baltic fixed income markets.

The new UI...

FILS USA: The complexities of routing an order

A great session on selecting trading protocols at the Fixed Income Leaders Summit in Boston, allowed traders to consider what really say behind counterparty...

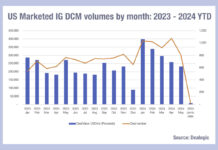

High Yield issuance is taking off

Comparing corporate bond issuance volumes for 2023 and 2024, we can see that the pattern is frequently a high start to the year, with...

Meet the consolidated tape contenders

Europe’s development of a consolidated tape for trading data now has clear front runners, and benefits.

Three firms have confirmed they will compete to be...

Tech, not tape, needed to harness fixed income data

Asset managers' lives could be made easier if they had access to a high quality source of fixed income data – and the technology...

BondWave partners DbCom to deliver transaction analytics to EQube users

BondWave, a fixed income fintech, has integrated its pre-trade and post-trade transaction analytics with DbCom’s business and compliance platform, EQube.

Delivered through BondWave’s application programming...