Aquis selected for Central Bank of Colombia government bond market

Banco de la República, the Central Bank of Colombia, has selected Aquis Exchange to provide technology and support services for Sistema Electrónico de Negociación...

MarketAxess re-launches Mid-X in Europe

MarketAxess has relaunched its matching session solution Mid-X in Europe, after simplifying the fee structure.

Mid-X offers daily, fully anonymous, matching sessions at the firm’s...

Overbond integrates Neptune Networks axe data

Overbond, an AI-driven fixed income analytics and trade workflow automation provider, has integrated Neptune Networks’ axe data to help buy-side traders more efficiently discover...

Improved auto-quoting tops wishlist for corporate bond investors

Improved auto-quoting tops the list of what corporate bond investors would like to see more of from their liquidity providers. That is according to...

Genesis launches web-based middle-office solution for fixed income trading

Genesis Global, a financial services software development company, has launched a web version of its multi-asset class middle-office solution, Trade Allocation Manager (TAM). Genesis...

Bloomberg unveils fully automated basis trade and reporting workflow

Bloomberg has rolled out a fully automated electronic workflow for the trading and reporting of EUR interest rate swap (IRS) v bond future contracts...

Adroit: Fixed income EMSs must reach beyond trading venues

Adroit Trading Technologies has raised US$15 million in a Series A round led by Centana Growth Partners. The cash will be spent on expanding...

Opening the black box: SOLVE’s new AI claims to predict ‘next-trade’ bond prices

SOLVE, provider of pre-trade quotes data across fixed income markets, has rolled out an artificial intelligence platform (AI) that is designed to predict the...

MarketAxess claims X-Pro boosts trader efficiency by 20%

MarketAxess has presented its new X-Pro trading interface as delivering a significant efficiency boost to bond traders.

Speaking with analysts on the firm’s Q4 2023...

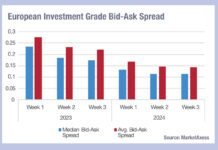

What is behind the falling cost of IG liquidity?

The bid-ask spreads in credit trading across the Europe and US have fallen dramatically in the first three weeks of 2024, relative to the...