Credit Market Structure Alliance: The real market agenda

The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been...

European buy-side to gather for European Fixed Income Trading Summit

Europe’s buy-side fixed income traders and portfolio managers will gather at the Four Seasons Milan on 2-3 March for Institutional Investor’s second annual European...

EWIFA Winners: Team players

Bloomberg’s Paula Fry, Global Head of Fixed Income and FX Trading Liquidity and winner of Excellence in Leadership, with Katharine Furber, Global Head of...

Coalition Greenwich: Return on investment now viable for fixed income EMS

Dated fixed income markets are set to undergo a rapid technological transformation. But it is from a low bar, with fixed income 10 to...

Beyond Liquidity: Strong volume year expected for listed derivatives

Global listed derivative volumes are expected to remain strong in 2023 after reaching a record last year, according to data tracked by Liquidnet.

2022 global...

The Agency Broker Hub: Exchange traded derivatives – key European trends

Carmine Calamello, Head of Brokerage Desk, Market Hub – Intesa Sanpaolo Group

Some argue that the origin of derivatives contracts can be traced back to...

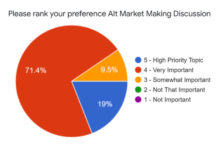

Credit Market Structure Alliance conference fights to bypass commercial debate

Now in its second year, the CMSA conference fights for the right to maintain integrity on stage.

ViableMkts is hosting the next installment of the...

Clearstream provides transparency into bond liquidity

Adel Humayun, Analyst in the Quantitative Analytics team at Deutsche Börse, and Catherine Jimenez, Head of Strategic Market Development in Eurobonds Product at Clearstream discuss the recently...

Viewpoint: Technology and the evolution of fixed income trading

Steve Toland, co-founder TransFICC

The fixed income and derivatives market is evolving, rapidly migrating away from the phone onto electronic venues. Electronic trading satisfies the...

Doing more with less: TS Imagine launches best execution compliance module

TS Imagine, a cross-asset provider of real-time trading, portfolio and risk management solutions, has rolled out a module within TradeSmart OEMS and TS One...