The DESK’s Risk & Return is the single channel for issuers and investors to access data, research, legal advice and credit rating information to support issuance and investment in debt via the primary market.

INSIGHTS & ANALYSIS

Insight & Analysis: Eighty percent of liquidity disappeared from long bond future post 2...

Ten ticks’ depth of order book collapsed as liquidity providers fled unprecedented volatility, analysis from The DESK shows.

After an initial flight to safety on 2 April, liquidity evaporated from the depth of order book...

ORIGINATION

Origination: Mars issues US$26 billion to acquire Kellanova

Mars Inc has issued US$26 billion in senior notes in a private transaction to fund its acquisition of snacking company Kellanova, formerly Kellogg’s.

The offering is expected to close on or around 12 March 2025.

The...

INVESTOR DEMAND

Investor demand: China’s US$759bn Treasury holdings hang by a thread as tariff war escalates

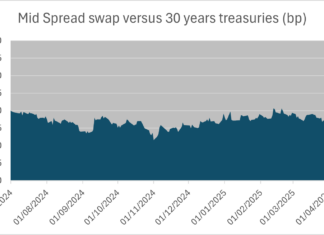

A continued sell-off in Treasury bonds, exacerbated after a notably poor 3-year auction on Tuesday, 8 April, has sparked widespread speculation among market participants. Analysts have proposed several drivers, including basis trades, SOFR versus...

RULES & RATINGS

Rules & Ratings: Italy in “strong position” to weather tariffs, S&P says

S&P Global Ratings has raised its unsolicited long-term foreign and local currency sovereign credit ratings for Italy to BBB+, with a stable outlook. Short-term ratings have been affirmed as A-2.

The change has been made...

THE BOOK

The Book: HP prices US$1 billion in senior notes, prepares for tariffs

HP Inc has priced US$1 billion aggregate principal in senior unsecured notes ahead of 25 April issuance.

Half the notes will be issued with 5.400% coupons and due in 2030, with the remainder maturing in...

This page is dedicated to research articles on primary fixed income markets. For further information please contact Dan Barnes.