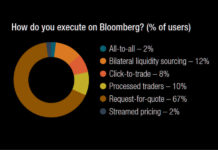

The DESK’s Trading Intentions Survey 2020 : Bloomberg

Bloomberg has a strong position as data provider, interface into the market and a trading venue.

The ubiquitous terminal allows it to build new services...

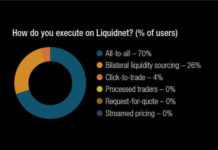

The DESK’s Trading Intentions Survey 2020 : Liquidnet

LIQUIDNET.

Liquidnet’s strength as a block-trading platform in the equity market may have paved its way for buy-side adoption in bonds, but it has certainly...

The DESK’s Trading Intentions Survey 2020 : MarketAxess

MarketAxess is rated as the most effective platform for finding liquidity in the corporate bond space by buy-side traders, and is a constant contender...

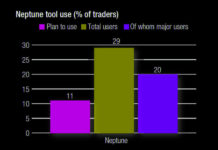

The DESK’s Trading Intentions Survey 2020 : Neptune

NEPTUNE.

The only one of the first-generation, pre-trade data providers to thrive, Neptune is a firm favourite. Described by its interim CEO, Byron Cooper-Fogarty, as...

The DESK’s Trading Intentions Survey 2020 : Streamed dealer prices

STREAMED DEALER PRICES.

Streaming prices from dealers provide a key perspective on the market, but unless they are executable they have limited value for trading....

The DESK’s Trading Intentions Survey 2020 : Tradeweb

TRADEWEB.

A real innovator in the trading protocol space, Tradeweb is constantly vying for the top spot with Bloomberg and MarketAxess.

Its pioneering of portfolio trading...

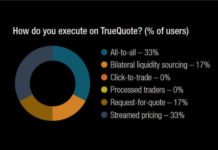

The DESK’s Trading Intentions Survey 2020 : TrueQuote

TRUEQUOTE.

A new entrant in the market in 2019, TrueQuote has seen remarkable success, rapidly building market share and moving quickly to develop trading protocols...

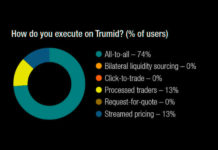

The DESK’s Trading Intentions Survey 2020 : Trumid

TRUMID

Trumid has experienced astounding growth over the past year, with average daily trading volume in January up 325% over January 2019, reaching US$761m, which...

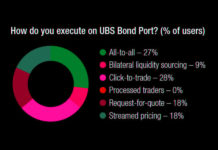

The DESK’s Trading Intentions Survey 2020 : UBS Bond Port

Adopting an agency approach has allowed UBS to deliver a service that has eluded many other banks via Bond Port.

As a result, the...

Pre-trade data demand grows and platform concentration weakens

The 5th Annual Trading Intentions Survey sees a hunger for data and a surge in new liquidity tools.

Key takeaways:

• Massive growth for crossing / mid-point...