Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

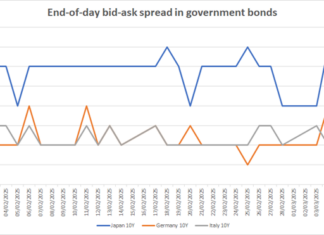

Orderly sell-off despite Bund bid-ask spread blow out

Borrowing costs for the German government spiked after an announcement of increased expenditure for its military, triggering a sell-off in German government bonds (bunds)...

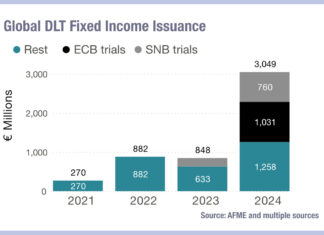

Measuring digital bond issuance

The use of distributed ledger technology (DLT) to issue bonds can tackle several concerns in the debt markets. Firstly, it reduces the fragmented information...

BGC CEO to divest ownership if appointed US Secretary of Commerce

Howard Lutnick, CEO of interdealer broker, infrastructure and data provider, BGC Group, has said he would leave the business entirely if he is appointed...

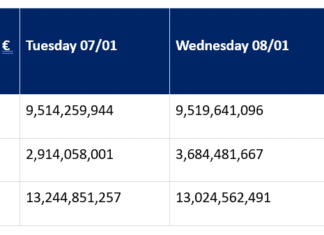

Gilt activity spikes as new rates reality bites government borrowers

By Dan Barnes and Etienne Mercuriali

Gilts market opening on the morning of 9 January suggested some traders took a big hit, with stop losses...

On The DESK: Leaders in bond trading pinpoint risks and opportunities

We asked the buy-side traders we have profiled on The DESK for the past ten years to discuss the biggest changes they thought had...

The Book: BofA DCM team give issuers confidence for financing in...

The DESK spoke with Bank of America’s Julien Roman, head of EMEA DCM FIG Origination, Paula Weisshuber, head of EMEA Corporate DCM, and Adrien...

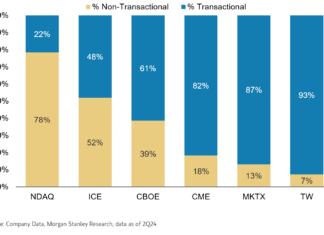

Insights and analysis: Morgan Stanley 2025 – ‘Timing Is Everything’ across...

Morgan Stanley’s outlook for 2025 finds a “still-moderate macro environment” with the mood heading towards deregulation, which it notes is largely is constructive for...

E-trading platforms show mixed results in October’s market share battle

Electronic trading fixed income platforms saw a slight drop off in volume relative to October, but strong activity against the same period last year.

Bond...

Dealers face crunch on platform trading costs

As bid-ask spreads tighten and fees rise, dealers question making markets in credit.

It does not take a quant to understand that tighter bid-ask spreads...