CUSIP issuance up YoY, but March decline signals concern

Year-to-date CUSIP issuance, which is indicative of new debt securities being issued, has increased year-to-date against 2024 figures, according to CUSIP Global Services (CGS).

Its latest...

US markets seeing risk implied in bid-ask spread

While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to...

BGC CEO to divest ownership if appointed US Secretary of Commerce

Howard Lutnick, CEO of interdealer broker, infrastructure and data provider, BGC Group, has said he would leave the business entirely if he is appointed...

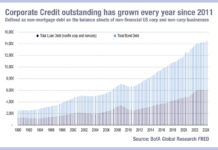

Refinancing debt: New bonds, old problem

A new paper from Bank of America’s credit strategist Neha Khoda and Adam Vogel has found that bond issuers are facing a significant increase in costs...

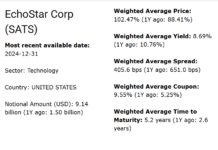

Origination: Issuer profile – EchoStar Corp

EchoStar Corp saw the largest proportional increase in notional debt outstanding in the technology sector in 2024, with a 509% increase, taking it to...

The cost of transparency and the value of information

Transparency can smell like information leakage by any other name, to butcher a Shakespeare quotation. Giving up information needs to happen at the latest...

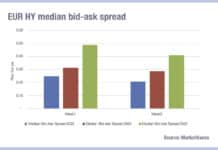

Bid-ask spreads see double-digit tightening in early 2025

Analysis of MarketAxess’s CP+ data, which analyses composite trading costs based on traded bonds, has found that bid-ask-spreads have tightened by double digit percentages...

Competition for debt issuance fierce as activity remains

Primary debt markets are likely to be a major revenue earner for dealers facing tighter margins in secondary bond markets. Issuance has started strongly...

On The DESK: Leaders in bond trading pinpoint risks and opportunities

We asked the buy-side traders we have profiled on The DESK for the past ten years to discuss the biggest changes they thought had...

Competition in credit futures heating up with ICE/MarketAxess/MSCI launch

Intercontinental Exchange's (ICE) has launched four new corporate bond index futures, designed to answer institutional investors' appetite for credit futures.

The product launch comes after...