How e-trading won bond investors an opportunity in the Venezuelan crisis

The dramatic escalation of Venezuela’s political crisis — culminating in the US military operation that removed Nicolás Maduro from power — has triggered a...

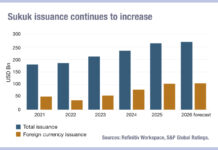

S&P Global: Record sukuk issuance in 2025

S&P Global has reported that global sukuk issuance hit US$264.8 billion in 2025, up from $234.9 billion in 2024, driven by solid economic growth...

J.P. Morgan Execute powers the future of e-trading

Close teamwork is seamlessly delivering sophisticated services to the users of J.P. Morgan’s Execute platform.

J.P. Morgan’s Execute platform has 4,000 users globally, and facilitates...

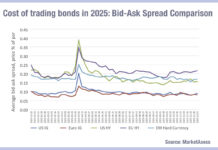

Cross-asset TCA is viable in credit markets

Can transaction cost analysis (TCA) provide an apples-for-apples comparison of buy-side trading costs across different asset classes? Imposing a single measurement framework across markets...

Bid-ask spread volatility highest in US bond markets

When comparing liquidity across markets in 2025, buy-side bond traders may consider European investment grade markets to have an optimal set of characteristics. However,...

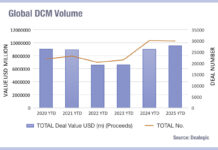

Dealogic: DCM deals in 2025 up 18% on five-year average

The preliminary view of 2025 capital markets deals, published by Dealogic, has found that global DCM volume delivered a total of US$9.5 trillion, 19%...

Competition in US Treasury clearing could sustain vicious exchange battle

The bitter competition between FMX and the CME, for trading of US Treasuries and Treasury futures, could enter an accelerated phase as new clearing...

Opportunities in e-trading credit derivatives

Credit futures and swaps complement each other by providing investors with different but interconnected tools to manage credit risk, hedge exposures, and to gain...

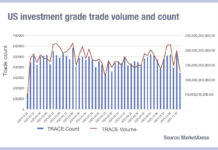

US credit activity dropped off a cliff in late November

Analysis of US corporate bond market activity has found that trading volumes and counts plummeted going into the final month of the year. A...

Scottish ‘vanity’ issuance project puts investors at risk from independence

The Scottish Government has confirmed plans to enter the bond market and issue £1.5bn of debt in 2026-2027.

Ben Ashby, chief investment officer at...