BondAuction to introduce auctions for bond issuance by year end

BondAuction, a new platform to support bond issuance, is planning to have its system to support a new auction process operable by mid-2022 with...

NatWest, Santander with Fnality, Nivaura and Adhara execute cross-chain Ethereum debt transaction

Three UK financial technology firms, Fnality, Nivaura and Adhara, in collaboration with European banks Santander and NatWest have completed a pilot, proof of concept...

Get it together: Traders seek primary market harmony

With issuance expected to stay high in 2022, traders appeal for a streamlined approach to primary market interfaces.

The level of global bond issuance in...

Société Générale, HSBC and MUFG join DirectBooks; US$1.6 trillion processed in 2021

Société Générale, HSBC, and Mitsubishi UFJ Financial Group (MUFG), have joined the DirectBooks platform bringing the total to 19 global underwriters live on DirectBooks.

In...

Credit Suisse and VTB fined millions by UK, US and Swiss authorities over Mozambican...

Credit Suisse Group AG has agreed to pay nearly US$475 million to Swiss, UK and US authorities, including nearly $100 million to the US...

FILS 2021: Liquidnet gives detail on new primary market offering

Liquidnet’s primary market offering for the bond market was laid out by Dan Hinxman, head of sales for Liquidnet Fixed Income at the Fixed...

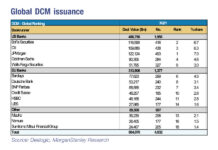

The winners in the primary market

In the bond issuance markets, there have been a few subtle changes in the top five most successful banks for syndication, and less subtle...

EU begins NGEU bill auctions but secondary market needs support

The European Union’s new bond issuance auction programme started on 15 September, via the TELSAT auction system operated by Banque de France for its...

Liquidnet Primary Markets launches for Europe and US

Liquidnet, the block trading specialist which is part of TP ICAP, has launched its hotly anticipated Liquidnet Primary Markets service, a new offering providing...

ISIN at issuance launched for Eurobonds by Origin

Origin Markets, the debt capital markets fintech, is launching an instant-ISIN feature, created in collaboration with international central securities depositary (ICSD) Clearstream, which is...