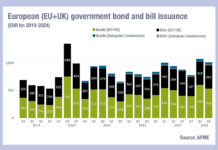

UK government debt issuance soars

The latest report from the Association for Financial Markets in Europe (AFME), looking at European government bond markets, found that €1 trillion of bonds...

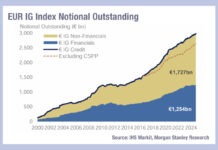

Ongoing effect of CSPP on European credit markets

Europe has seen considerable growth in credit issuance this year relative to 2023, with last week finding a 116% year-on-year increase in non-financial high...

FILS 2024: “Cause for optimism” in primary markets

While the majority of trading in secondary markets happens electronically, primary markets are falling behind and continue to favour manual workflows. However, there’s cause...

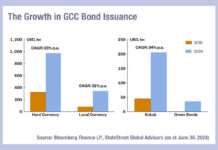

Key trends in emerging markets debt issuance in 2024

Emerging market debt is seeing the effects of government reforms in both democracies and autocracies this year, with stability being the watch word for...

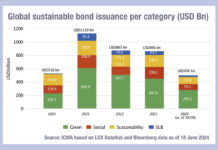

Sustainable bond issuance now 12% of total market

A report co-authored by Nicholas Pfaff, Valérie Guillaumin, Simone Utermarck, Ozgur Altun and Stanislav Egorov of the International Capital Markets Association (ICMA), has found...

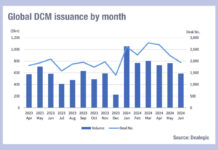

Issuance in double figure growth everywhere (ex-Japan!)

The debt markets have been booming globally in the first half of 2024, according to Dealogic data, with Middle East and Africa seeing issuance...

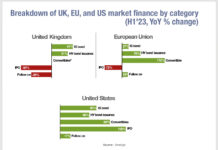

Issuance of debt increasingly financing UK companies

Analysis of corporate financing across European, UK and US markets by the Association of Financial Markets in Europe (AFME) has found that over the...

Primary ignition – at both ends

Politics are being sidelined in the battle for efficiency in primary markets for buyers and for issuers

The top operational priority for buy-side traders in...

The pros and cons of record issuance

Bond markets typically see increased liquidity around a bond shortly after it is issued. However, this does not mean that markets are automatically more...

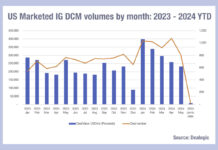

High Yield issuance is taking off

Comparing corporate bond issuance volumes for 2023 and 2024, we can see that the pattern is frequently a high start to the year, with...