Measuring digital bond issuance

The use of distributed ledger technology (DLT) to issue bonds can tackle several concerns in the debt markets. Firstly, it reduces the fragmented information...

Origination: KfW drives the leading edge of bond issuance

The supranational, sub-sovereign and agency (SSA) bond issuers are expected to be the most forward looking issuer group in evolving primary debt markets.

The DESK...

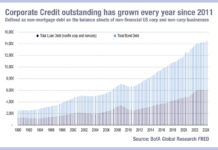

Refinancing debt: New bonds, old problem

A new paper from Bank of America’s credit strategist Neha Khoda and Adam Vogel has found that bond issuers are facing a significant increase in costs...

The Book: Who will drive reform in primary markets?

Primary market practices are under pressure to change, however the urgency and direction given for adaptation are often skewed by specific market participant groups.

The...

Competition for debt issuance fierce as activity remains

Primary debt markets are likely to be a major revenue earner for dealers facing tighter margins in secondary bond markets. Issuance has started strongly...

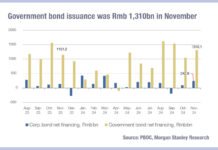

China government bond issuance reducing transparency of total social finance

Understanding state support for the economy in China can be measured across several dynamics, but debt provision to the non-financial private sector, known as...

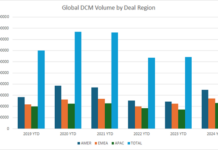

DCM deals substantially up year-on-year

Total deal size volume for debt capital markets, year-to-date is up 32% on 2023, according to data from Dealogic.

The trend in regional deals has...

The Book: BofA DCM team give issuers confidence for financing in 2025

The DESK spoke with Bank of America’s Julien Roman, head of EMEA DCM FIG Origination, Paula Weisshuber, head of EMEA Corporate DCM, and Adrien...

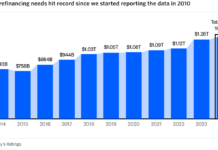

Moody’s: Short-term refinancing to grow in 2025

A report from rating agency Moody’s, has found that the proportion of US non-financial investment-grade corporate bonds needing refinancing within five years has grown...

The greatest surprises in bond trading of the last decade

The DESK asked interviewees from its ‘On The DESK’ profile interviews of the last ten years to assess the most surprising changes they had...