The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Exclusive: Competition fails to cut prices for FX dealers

When Bloomberg announced, in Q4 2024, that it was to start charging dealers for using FXGO, its foreign exchange trading service, a number of...

Direct streaming on credit trading platforms

Sell-side bond trading counterparties price trades according to their clients’ profiles, based on tiering systems. That model directs the pricing of risk according to...

UPDATED: UBS continues to swing axe

UBS, the investment banking giant has reportedly cut further jobs from its markets division, with many people internally fearing more jobs are to go,...

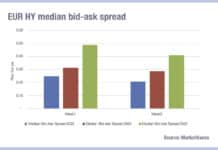

Orderly sell-off despite Bund bid-ask spread blow out

Borrowing costs for the German government spiked after an announcement of increased expenditure for its military, triggering a sell-off in German government bonds (bunds)...

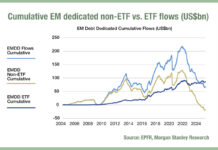

Inflows to EM debt beta funds could change trading patterns

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while...

BGC CEO to divest ownership if appointed US Secretary of Commerce

Howard Lutnick, CEO of interdealer broker, infrastructure and data provider, BGC Group, has said he would leave the business entirely if he is appointed...

Bid-ask spreads see double-digit tightening in early 2025

Analysis of MarketAxess’s CP+ data, which analyses composite trading costs based on traded bonds, has found that bid-ask-spreads have tightened by double digit percentages...

Competition in credit futures heating up with ICE/MarketAxess/MSCI launch

Intercontinental Exchange's (ICE) has launched four new corporate bond index futures, designed to answer institutional investors' appetite for credit futures.

The product launch comes after...

OpenYield set for expansion with latest funding round

Closing a US$7 million funding round, bond marketplace OpenYield plans to boost its client base, drive global expansion and expand its product range. The...