European govies issued at record level in Q1

This year saw the highest first-quarter European government bonds and bills issuance volume since 2006 as €1.2 trillion was issued in Q1 2025, according...

The Book: Who will drive reform in primary markets?

Primary market practices are under pressure to change, however the urgency and direction given for adaptation are often skewed by specific market participant groups.

The...

Row erupts as CBOE seeks to define exchange boundaries

An application by multi-asset market operator, CBOE, to define what is considered a ‘facility’ of the exchange, has triggered a row. The firm sought...

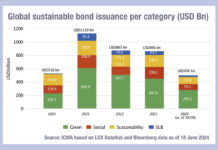

Sustainable bond issuance now 12% of total market

A report co-authored by Nicholas Pfaff, Valérie Guillaumin, Simone Utermarck, Ozgur Altun and Stanislav Egorov of the International Capital Markets Association (ICMA), has found...

Shielding from exploding issuance

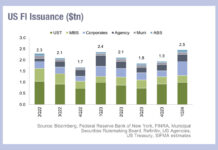

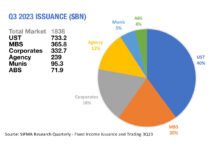

US fixed income markets saw issuance in Q1 2024 hit US$2.5 trillion according to the Securities Industry and Financial Markets Association (SIFMA), an increase...

Country focus: India’s bond markets in an election year

India has an upcoming election on 19 April, which the governing Bharatiya Janata Party (BJP), led by incumbent Prime Minister Narendra Modi, is widely...

Betting the house

Mortgage origination in the US is predicted by the Mortgage Bankers Association (MBA) to rise significantly across 2024-25, yet trading of securitised mortgages still...

This! Is! What! Liquidity! Looks! Like!

In the past quarter, the average daily notional traded for US Treasuries was 99.5% of the total value of securities issued in the same...

Report: China’s pension stress represents opportunity for global buy side

Global asset managers should take note of the investment opportunities presented by China’s pension fund market as the space embraces much-needed reform and technological...

AFME welcomes political agreement over CSDR mandatory buy-in

The Association for Financial Markets in Europe (AFME) has welcomed political agreement regarding the European Union's refit of the Central Securities Depositories Regulation (CSDR)....