Exclusive: Competition fails to cut prices for FX dealers

When Bloomberg announced, in Q4 2024, that it was to start charging dealers for using FXGO, its foreign exchange trading service, a number of...

Direct streaming on credit trading platforms

Sell-side bond trading counterparties price trades according to their clients’ profiles, based on tiering systems. That model directs the pricing of risk according to...

UPDATED: UBS continues to swing axe

UBS, the investment banking giant has reportedly cut further jobs from its markets division, with many people internally fearing more jobs are to go,...

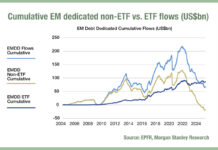

Inflows to EM debt beta funds could change trading patterns

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while...

The Book: BofA DCM team give issuers confidence for financing in 2025

The DESK spoke with Bank of America’s Julien Roman, head of EMEA DCM FIG Origination, Paula Weisshuber, head of EMEA Corporate DCM, and Adrien...

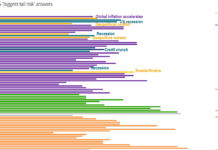

Investor Demand: BofA Global Fund Manager Survey sees bullish US investor appetite

The Bank of America Global Fund Manager Survey (FMS) conducted Nov 1st-7th; post-US election, found that respondents have higher global and US growth expectations,...

Hamza Hoummady made head of European rates trading at Barclays

Barclays Investment Bank has named Hamza Hoummady as head of European rates trading, promoting him from head of EMEA non-linear rates trading, rates structuring...

Liquidity provider profile: Millennium Advisors

The DESK looks at fixed income liquidity providers business models in depth.

This month, we spoke with Millennium Advisors' Laurent Paulhac, group CEO and Caroline...

Dealers face crunch on platform trading costs

As bid-ask spreads tighten and fees rise, dealers question making markets in credit.

It does not take a quant to understand that tighter bid-ask spreads...

Reports: MTS to launch D2C initiative with backing from major dealers

Several market sources have reported that MTS Markets, the fixed income trading division of Euronext, is to launch a dealer-to-client credit trading offering through...