OpenYield set for expansion with latest funding round

Closing a US$7 million funding round, bond marketplace OpenYield plans to boost its client base, drive global expansion and expand its product range. The...

Discussions between TP ICAP and Neptune reported

Multiple market sources have reported that discussions between pre-trade data provider Neptune and TP ICAP, the multi-asset trading, interdealer broker and data services firm,...

Investor Demand: BofA Global Fund Manager Survey sees bullish US investor appetite

The Bank of America Global Fund Manager Survey (FMS) conducted Nov 1st-7th; post-US election, found that respondents have higher global and US growth expectations,...

Bloomberg drops RUNZ forwarding over information leakage fears

On 10 September 2024 Bloomberg started automatically blocking the forwarding of RUNZ-formatted messages.

A RUNZ formatted message is an email message composed on the Bloomberg...

Rules & Ratings: Understanding gaps between credit risk data and credit ratings

While credit ratings underline investor confidence and evaluation of debt products, credit risk data can potentially offer a more nuanced source of information for...

E-trading platforms show mixed results in October’s market share battle

Electronic trading fixed income platforms saw a slight drop off in volume relative to October, but strong activity against the same period last year.

Bond...

Hamza Hoummady made head of European rates trading at Barclays

Barclays Investment Bank has named Hamza Hoummady as head of European rates trading, promoting him from head of EMEA non-linear rates trading, rates structuring...

Measuring implicit costs and market impact in credit trading

Evaluating the quality of a bond trade is made complex by the multiple dynamics which impact quality, and the frequent absence of data to...

Under pressure

Secondary markets trading has seen a net trend towards tighter bid-ask spreads for trading across all corporate bond segments in US, Europe and emerging...

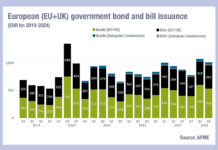

UK government debt issuance soars

The latest report from the Association for Financial Markets in Europe (AFME), looking at European government bond markets, found that €1 trillion of bonds...