On the Desk: David Walker – Trading with your feet on the ground

David Walker, head of fixed income trading at M&G Investments, discusses no-ego trading, the importance of direct contact with markets, and strong banks relationships.

How...

FILS USA: The three fierce battles for credit e-trading market share

Electronic trading in US fixed income is hotly contested between Bloomberg, MarketAxess, Tradeweb and Trumid all competing for market share of trading cash bonds...

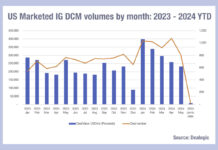

High Yield issuance is taking off

Comparing corporate bond issuance volumes for 2023 and 2024, we can see that the pattern is frequently a high start to the year, with...

Tradeweb connects repo and IRS markets in electronic workflow

Multi-asset market operator, Tradeweb has launched features that bridge the firm’s repurchase agreements (repo) and interest rate swap (IRS) product offerings to support clients’...

Primary ignition – at both ends

Politics are being side lined in the battle for efficiency in primary markets for buyers, and for issuers.

The top operational priority for buy-side, and...

EXCLUSIVE: abrdn’s automation journey sees no-touch jump

Louise Drummond, global head of investment execution at abrdn, discusses the firm’s path towards workflow automation – an achievement that has been almost a...

Bigger / smaller: What sizes are optimal for electronic trading?

Credit trading has been transformed by evolving electronic execution, which has allowed buy-side desks to express investment ideas in to the market using more...

Meet the consolidated tape contenders

Europe’s development of a consolidated tape for trading data now has clear front runners, and benefits.

Three firms have confirmed they will compete to be...

Exclusive: TS Imagine connects with TDS Automated Trading for muni market-making

Trading systems provider, TS Imagine, has connected to municipal bond market maker TDS Automated Trading (TDSAT), through its TradeSmart Fixed Income execution management system...

Tradeweb talks up futures market; reports Q1 growth, LSEG confusion

Tradeweb, a subsidiary of London Stock Exchange Group (LSEG), saw continued outperformance in fixed income markets in the first quarter (Q1) of 2024.

Tradeweb’s...