Discussions between TP ICAP and Neptune reported

Multiple market sources have reported that discussions between pre-trade data provider Neptune and TP ICAP, the multi-asset trading, interdealer broker and data services firm,...

Bloomberg drops RUNZ forwarding over information leakage fears

On 10 September 2024 Bloomberg started automatically blocking the forwarding of RUNZ-formatted messages.

A RUNZ formatted message is an email message composed on the Bloomberg...

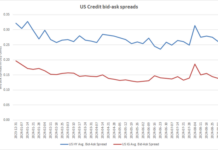

Falling costs of liquidity not halted by summer vol

The bid-ask spread for corporate bond markets has continued on a downward trajectory in September, after a bump in August, according to data from...

Ten years of research: Lessons for trading platforms in fixed income

Lessons on the viability and competitiveness of liquidity aggregation tools can be drawn form the last decade of research conducted by The DESK.

In 2015...

Exclusive: Bloomberg Message “sprayed dealer runs across the street”

Sources, including several dealers, have confirmed that Bloomberg’s Message service, used by broker dealers for sending runs to clients, “sprayed dealer runs across the...

Market gives cautious response to Sweden’s ‘detail-lite’ MiFID II deal

The Swedish presidency of the Council of the European Union (Council) reached a last-minute agreement with the EU Parliament on proposed changes to the...

Mizuho EMEA joins Neptune to distribute real-time axe data

Mizuho EMEA has joined Neptune Networks, the fixed income network for disseminating real-time axe data.

Neptune delivers axes from 32 of the leading dealers...

Is the market braced for another sell-off?

Traders are reporting the positive effects of innovation upon market liquidity but central banks hold all the cards.

The association between the Covid 19 pandemic...

7 Chord’s EM sovereign and corporate bond feed prices on Nasdaq’s Quandl

Predictive bond prices and analytics provider, 7 Chord, has expanded its data offering on Nasdaq's Quandl. Bond investors and dealers can now leverage Python,...

Overbond to integrate Euroclear LiquidityDrive into real-time bond trading automation

Overbond, the provider of AI quantitative analytics for institutional fixed income capital markets is to integrate Euroclear LiquidityDrive settlement-layer data for fixed income trade...