Exclusive: Competition fails to cut prices for FX dealers

When Bloomberg announced, in Q4 2024, that it was to start charging dealers for using FXGO, its foreign exchange trading service, a number of...

Direct streaming on credit trading platforms

Sell-side bond trading counterparties price trades according to their clients’ profiles, based on tiering systems. That model directs the pricing of risk according to...

UPDATED: UBS continues to swing axe

UBS, the investment banking giant has reportedly cut further jobs from its markets division, with many people internally fearing more jobs are to go,...

Orderly sell-off despite Bund bid-ask spread blow out

Borrowing costs for the German government spiked after an announcement of increased expenditure for its military, triggering a sell-off in German government bonds (bunds)...

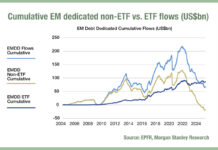

Inflows to EM debt beta funds could change trading patterns

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while...

US president to oversee financial institution regulation amid deregulation drive

New executive orders signed by US president, Donald Trump, have given him oversight of all US financial regulation, outside of monetary policy, while also...

Origination: Brookings Institute: Threat from US debt levels very limited

A new paper by the Brookings Institute has highlighted reasons for concern around the growing US debt pile, and the dynamics that could affect...

Emerging markets see liquidity costs decline

The cost of liquidity in emerging markets appears to be falling for fixed income traders. Looking at MarketAxess’s CP+ consolidated price feed, and cross-referencing...

Measuring digital bond issuance

The use of distributed ledger technology (DLT) to issue bonds can tackle several concerns in the debt markets. Firstly, it reduces the fragmented information...

Rules & Ratings: US rate cuts now challenged by tariff policy

The use of trade tariffs between the US and potentially Mexico, Canada, the European Union and certainly China, which had a 10% tariff imposed...