Market structure: Is e-trading plateauing?

The overall pace of bond market electronification is slowing, but trading evolution is not linear.

Electronic trading has grown as a proportion of total trading,...

Research: Trading Intentions Survey 2023

Major platforms show stable leadership in corporate bond trading

Some notable changes in results this year also reflect a change in demographics from respondents. This...

Wall Street 2022: bonuses fell 26%

Wall Street’s 2022 average bonus paid to securities employees dropped to $176,700, a 26% decline from the previous year’s $240,400, according to New York...

AT1 trading volume was elevated a week ahead of Credit Suisse wipe-out

Trading in AT1 bonds spiked on Monday 20th March as a result of the Credit Suisse rescue at the weekend, with one platform trader...

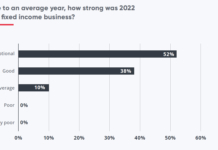

Dealers had ‘exceptional’ 2022 for fixed income; JP Morgan tops Q1 DCM winners

Research by front-office technology provider, valantic FSA, and analyst firm, Acuiti, has found that 52% of dealers had an ‘exceptional’ year for fixed income...

When banks go bust holding boring bonds

**This article will appear in full in the next issue of The DESK**

Government bonds are described as a 'risk-free' instrument, on the basis that...

Coalition Greenwich’s deep dive into fixed income TCA

A report by analyst firm Coalition Greenwich has set out the tough but potentially rewarding path for increased adoption of transaction cost analysis in...

Digital bond issuance: From zero to US$1,500,000,000 in 12 months

S&P Global Market Intelligence has assessed that the digital bond market “remains a work in progress” as new bond issuance focuses on testing in...

EWIFA Winner: Turning challenge into opportunity

Serene Murphy, Head of Corporate Development for Europe & Asia at Tradeweb, talks market structure, adaptability and innovation.

Can you please tell me what is...

Consolidated tape: Can Europe replicate US market transparency?

Having spotted the need for a consolidated tape in 2005 – when the US already had one – Europe and the UK are so...