Market Structure: New risk and liquidity in the US Treasury market

Significant changes in counterparties and market structure have transformed US Treasury market activity.

Dealer-to-client trading has overtaken interdealer markets in volume traded according to analyst...

What’s all the fuss about… the US Treasury market?

Who is kicking up a fuss about US government bonds?

A new paper published by Darrell Duffie for the Jackson Hole Symposium entitled ‘Resilience redux...

What’s the fuss about… New capital rules?

What’s all this fuss about new capital rules? The US Federal Reserve has decided that some banks, with over US$100 billion in assets, need...

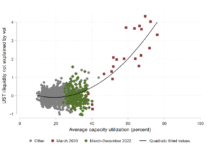

Analysis: Market response to US Treasury’s increased borrowing needs

The US Treasury’s need to increase debt issuance, beyond market expectations, has had several effects. Firstly there was a ratings downgrade of the USA...

Implication of US bank downgrades on credit markets

Markets are truly feeling the economic pressures at present, with Moody’s downgrade to US financials on Monday following Fitch’s controversial downgrade of the US,...

LatAm sees e-trading momentum with support for all-to-all

In Latin America, 46% of trading in corporate hard currency bonds is conducted electronically, according to research by analyst firm Coalition Greenwich, compared to...

Trading: Best practices for the sell-side desk

Buy-side traders do not have time to waste, so attention is key to a strong relationship.

We asked buy-side desks about the best ways their...

Derivatives: Credit default swaps – The revival

Applying innovation from corporate bond markets to credit derivatives trading could boost liquidity at a point of market stress.

Single-name credit default swaps (CDSs) provide...

Review: An apples-to-apples comparison of all-to-all trading platforms

We compare the very different all-to-all offerings provided by electronic trading platforms.

A good all-to-all offering can really support electronic liquidity provision, especially if traditional...

Research: Analytics use in trading workflow increases by 72% over three years

Effectiveness for reporting and desk performance assessment improves year-on-year.

The DESK’s latest research into trading analytics has found its use growing within the trading workflow,...

Subscriber