On The DESK: What it takes to build a multi-asset trading team

Since becoming global head of trading at Schroders, Gregg Dalley has helped his teams become a single, multi-asset trading unit.

The DESK: What is your team’s...

Barclays: Portfolio trading 8% of US credit market volume

Barclays has conducted new analysis into portfolio trading of corporate bonds, estimating the trading protocol now makes up 8% of US credit trading.

The firm...

The European Markets Choice Awards – The Finalists

Markets Media Europe is delighted to present a preliminary list of finalists for the 2022 European Markets Choice Awards.

The Instinet Positive Change Awards will...

The case for deferring reports of larger trades

The Association for Financial Markets in Europe (AFME) has published study consolidating fixed income trading data from numerous sources for the period of March...

CMSA – The drive to change industry dialogue in corporate bond markets

To create a wider dialogue around industry change, the Credit Market Structure Alliance (CMSA) is building an event with a democratic agenda.

The DESK: Why...

OMS market: Vendors focusing on strategic sales pitch

Research suggests that an apparently limited interest in changing order management systems (OMS) on buy-side trading desks has been overcome by OMS vendors at...

On The DESK: Tobi Molko, Bridgewater Associates

Talent acquisition, automation and the protection of trade data in the year ahead are key priorities for Tobi Molko, head of trading execution at...

Block trading investigations follow a long trend

Several investigations reported in the press are following regulatory scrutiny of block trading arrangements. The investigations reported by Bloomberg, Reuters and the Financial Times...

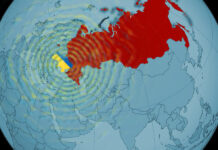

How e-trading connectivity has been fragmented by sanctions

Sanctions on the Russian regime, on associated firms and on individuals have restricted legal access to some instruments and counterparties, yet portfolio managers may...

Market disruption spreads beyond Ukraine and Russia

Traders are reported that liquidity across developed and emerging markets is being hit, with trades taking far longer to complete and price formation suffering...