SEC greenlights DTCC tokenisation initiative

The US Securities and Exchange Commission (SEC) has issued a no-action letter to the Depository Trust & Clearing Corporation (DTCC), allowing the company to...

Perkins joins Deutsche Bank

Sean Perkins has joined Deutsche Bank as director of high yield research. He is based in New York.

Perkins has more than 25 years of...

SocGen promotes Braham

Mohamed Braham has been promoted at Societe Generale CIB, being named as head of global markets, and APAC head of fixed income and currencies...

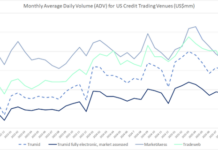

Tradeweb and MarketAxess beat TRACE growth in November

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion,...

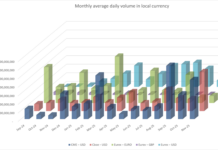

Cboe’s credit futures activity and OI leapfrogs CME and Eurex in November

In November, Cboe’s US dollar iBoxx iShares credit futures set new records with US$455 million in average daily volume (ADV) and US$1.95 billion in...

Jefferies increases credit focus with Hildene acquisition

Jefferies has acquired 50% interest in Hildene Holding Company, parent company of credit-focused Hildene Capital Management and its affiliates.

Hildene Capital Management holds more than...

Lord Abbett invests in IMTC

IMTC has closed a US$12 million Series A funding round, with Lord Abbett joining its ranks of investors.

The round was led by fintech-focused venture...

Simpler bond liquidity assessments diverge on either side of the Channel

British and European authorities are actively aiming to simplify bond liquidity and transparency regimes, but divergent reporting deferral rules for rates and credit, as...

Justesen joins Muzinich

Jakob Justesen has joined Muzinich as a fixed income trader. He is based in London.

Privately owned investment firm Muzinich specialises in public and private...

FIM Partners appoints emerging market debt trader

FIM Partners has hired Nicholas Nellis as a portfolio manager and trader focused on emerging-market debt.

He joins the London and Dubai-based investment manager after...