FILS USA 2023: Finding efficiency in fixed income trading

Market operators seek to expand reach of surprisingly resilient automation.

Fixed income trading has become much more efficient over the years, driven by new technologies...

FILS USA 2023: Traders test the water with new execution methods

The ability to use new trading protocols can be highly dependent upon the funds that a desk trades for and the types of instruments...

FILS US 2023: Traders need tech solutions that plug directly into their workflow

The View on Liquidity panel at FILS US 2023 had some stern words on the urgent need to integrate better protocols directly into workflows...

FILS US 2023: Trading protocols urgently need to evolve, says All-Star Panel

Panelists speaking on the All-star Protocol Predictions Panel in Nashville this week agreed that, love it or hate it, the request for quote (RFQ)...

Barclays survey finds half of clients trade 90% of rates tickets electronically

Barclays’ Market Structure team has released its third annual survey of bond market electronic trading for buy-side clients.

In rates markets, when asked what...

FILS USA 2023: Market volatility has tested e-trading and instrument selection

Having had a challenging and volatile first half of the year from a liquidity perspective, not least because of a crisis in US and...

FILS USA 2023: Macro effect on trading; BlackRock says higher rates ‘not fleeting’

The macro environment is having a major effect on the attractiveness of certain instruments, noted Sonali Pier, managing director and portfolio manager at PIMCO,...

Exclusive: Bloomberg and S&P Global Market Intelligence collaborate on bond issuance

Bloomberg and S&P Global Market Intelligence have launched an integrated solution to streamline the syndicated primary bond market lifecycle. Bond market issuance has historically...

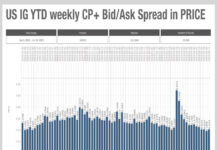

Liquidity costs ticking up as the heat rises

Summer is seeing the cost of trading in fixed income markets begin to tick up again, as bid ask spreads begin to widen, according...

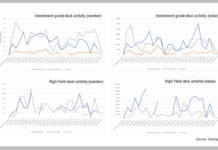

Aligning issuance and recession risk

Data from Dealogic is indicating highly variable bond issuance patterns in the US, European Union and UK markets, year-to-date.

This is understandable given the rapidly...