The Fed’s TMPG begins consultation on clearing and settlement in US Treasury repo

The Federal Reserve Bank of New York’s Treasury Market Practices Group (TMPG) has released a consultative white paper on clearing and settlement in the...

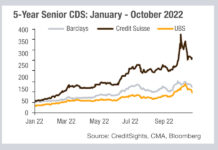

The vicious circle of trust and liquidity

Looking at data provided by CreditSights, we can see the extent of lenders’ concern about Credit Suisse this year. The cost of insuring Credit...

Liquidnet launches new issue bonds from OMS to banks; interoperability will set competition level

Block trading specialist Liquidnet has gone live with a new bond issuance process allowing transmission of buy-side orders in live market deals from order...

Tradeweb’s October volumes reflect turbulence in European and US markets

Tradeweb, the market operator across rates, credit, equities and money markets, has reported an average daily volume (ADV) for the month of US$1.05 trillion,...

BondWave’s fixed income engine integrates with ICE Bonds

BondWave, the fixed income system provider, has successfully integrated its Effi Markets tool with the ICE Bonds’ trading platforms.

Effi Markets provides access to indicative...

ICMA recommends ECB follows Federal Reserve and SNB policies

The International Capital Markets Association (ICMA) has written to the European Central Bank (ECB) with a “concern that rising dysfunction in the market...

Substantive Research reports market data pricing inconsistencies

Substantive Research, the data discovery and analytics provider for buy side firms, has published analysis of market data pricing, with a focus on opaque...

ICE Bonds receives approval for expansion in Canada

Intercontinental Exchange (ICE), the market operator and data/technology provider has received approval to operate its ICE TMC fixed income trading platform in all Canadian...

Charles River and DirectBooks collaborate on primary bond issuance

Charles River Development, a State Street Company, is collaborating with DirectBooks to support investment firms to manage primary issuance workflows in the Charles River...

FSB: Greater transparency, all-to-all trading and clearing could reduce rates markets dislocation

A paper by the Financial Stability Board (FSB), which coordinates international regulatory efforts to promote effective policies, has reported that dealer blame uncertainty over...