IMTC: Customising investment products efficiently in a rising rate environment

Technology is enabling investment managers to automate portfolio and instrument selection putting clients in the driving seat.

The DESK interviewed Russell Feldman, CEO of IMTC,...

Bloomberg: Better execution through bond trading analytics

Will Oberuch, Global Head of TCA Product at Bloomberg.

The DESK: Where do you see Bloomberg’s trading analytics being most effective today?

Will Oberuch: Our ability...

LSEG: Helping traders construct a single view of the market

Trading desks can customise their technology thanks to greater data democratisation and desktop interoperability, making trade analysis more effective than ever. This will allow...

Industry viewpoint: How to build a better picture of the global fixed income markets

Guido Galassi, Head of Data & Cash Product, MTS

In volatile market conditions, more accessible and meaningful data has become critical to navigating the path...

UBS: The client-led dealer driving best execution

Traditional sell-side firms can engage most effectively in fixed income by enabling, rather than pushing, buy-side strategy.

As markets face considerable operational pressure, delivering change...

White-paper summary: Filling the liquidity gap in bond index construction

Industry viewpoint: State Street Global Advisors SPDR® and MarketAxess

The success of ETFs in supporting bond market liquidity has been marred by a gap in...

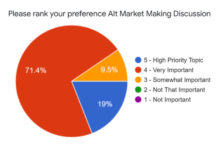

Credit Market Structure Alliance: The real market agenda

The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been...

Gain greater confidence in your automated trading decisions during market volatility

Charlie Campbell-Johnston, Managing Director, AiEX & Workflow Solutions at Tradeweb.

In times of volatility, traders need to react quickly to tricky market conditions – and automation...

CMSA – The drive to change industry dialogue in corporate bond markets

To create a wider dialogue around industry change, the Credit Market Structure Alliance (CMSA) is building an event with a democratic agenda.

The DESK: Why...

Case Study – BlueCove’s expansive view of fixed income markets

BlueCove’s expansive view of fixed income markets.

Recognising the need for smarter ways to assess market dynamics and connect with pools of liquidity, BlueCove has been...