Adaptive: The Modernization Mandate – Who Calls the Shots on Trading Tech?

The Modernization Mandate: Who Calls the Shots on Trading Tech?

Capital markets are at a critical inflection point, with firms navigating a complex transition from...

TransFICC: Portfolio Trading

Portfolio Trading – Technology is the Answer

Portfolio trading (PT) is transforming the Fixed Income market. It is no longer niche – in the US...

Cboe: Navigating Volatility

Navigating Volatility: The Rise of Cboe Credit Index Futures in a Transforming Bond Market

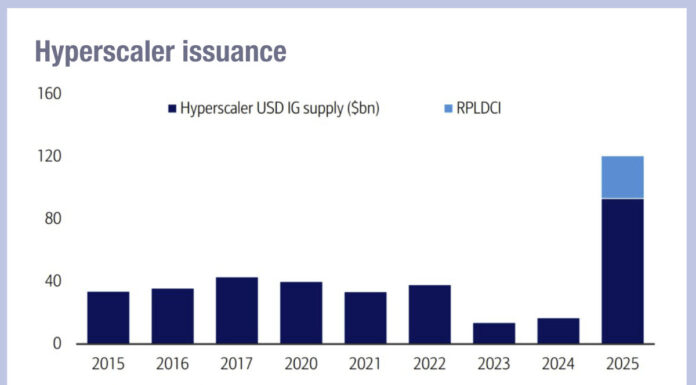

In an era defined by macroeconomic uncertainty and digital transformation, credit...

Eurex: OTC interest rate derivatives markets

Eurex Clearing OTC IRD momentum grows, with new participants and new currencies

In this article, Eurex Clearing’s Danny Chart, Global Product Lead for OTC Interest...

JP Morgan: A global market structure mindset – navigating diverging policies

Kate Finlayson, Managing Director, FICC Market Structure & Liquidity Strategy at J.P. Morgan, examines key market structure developments shaping trading behaviour as the global...

Bloomberg: Real-Time Pricing for Sovereign Bonds

Bloomberg Introduces Real-Time Pricing for Sovereign Bonds Across 14 Markets with Expansion of IBVAL Front Office

Eric Isenberg, Head of Enterprise Data Pricing and...

SOLVE: Eugene Grinberg (from a TraderTV interview)

Bringing the bond market’s loose ends together

Accurate bond pricing remains a challenge in today’s fixed income markets. Two critical issues stand in the way:...

TransFICC: The Evolution of the Muni Market

Driven by volume growth and technology

By Bo-yun Liu, Director of Product Solutions, TransFICC

Taken in aggregate, the Muni market is roughly $4.2T Outstanding with $15.6B...

Intelligent application of artificial intelligence in credit

A picture has emerged of the future credit desk for buy-side traders, from discussions at the Fixed Income Leaders’ Summit in Washington DC last...

S&P Global Market Intelligence: MarketAxess collaboration to enhance fixed income market transparency and efficiency

Following the announcement of a new data partnership between S&P Global Market Intelligence and MarketAxess, Traders Magazine* sat down with Kat Sweeney, Head of...