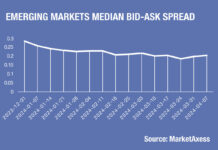

Bid-ask spreads drop 25% on average in many markets

The cost of liquidity as measured by the bid-ask spread in bond trading has fallen by approximately 25% since the start of the year,...

Bloomberg expands IBVAL front office pricing solution

Bloomberg has expanded its pricing solution, Intraday BVAL (IBVAL) Front Office, to cover EUR and GBP investment grade and high yield credit bonds included...

The Tenth Annual Trading Intentions Survey

Key parts of bond market electronification are still up for contention, with stiff competition across pre-trade, primary and secondary market services.

In 2024 The DESK...

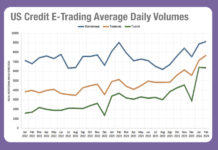

Exclusive: Analysing the battle for US e-Trading in February

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively...

How much credit should dealers get – and for how much risk?

There is a tension between best execution obligations and the longer-term value of a dealer supporting liquidity provision. Buy-side traders are aware that their...

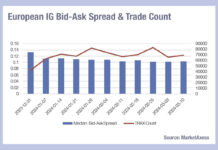

European investment grade seeing smaller, cheaper trades

European investment grade bond traders are seeing a falling bid-ask spread, and a rising trade count since the start of 2024, according to MarketAxess’s...

Balls calls for UK to adopt a more risk-assertive culture

Ed Balls, former economic secretary to the UK Treasury & shadow chancellor, has called for the UK to adopt a risk-positive culture in order...

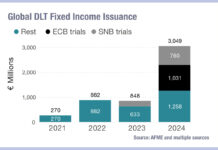

AFME: Buy- and sell-side debate value of new bond trading protocols

At the inaugural AFME Bond Trading, Innovation and Evolution Forum, panellists discussed the future opportunities of the international bond markets. As the discussion drew...

MarketAxess re-launches Mid-X in Europe

MarketAxess has relaunched its matching session solution Mid-X in Europe, after simplifying the fee structure.

Mid-X offers daily, fully anonymous, matching sessions at the firm’s...

LSEG FY 2023 results: Fixed income offsets wider capital markets drop

London Stock Exchange Group (LSEG) reported its full year (FY) 2023 results today, with earnings in line with expectations despite a slight drop in...