Tim Baker joins BMLL to expand firm’s US presence

BMLL, the provider of historical Level 3 data and analytics, has appointed of Tim Baker as senior adviser. Based in New York, Baker will...

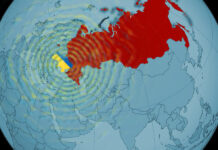

How e-trading connectivity has been fragmented by sanctions

Sanctions on the Russian regime, on associated firms and on individuals have restricted legal access to some instruments and counterparties, yet portfolio managers may...

Broadridge’s LTX completes integration with Charles River Development

LTX, Broadridge Financial Solutions’ artificial intelligence (AI)-driven digital trading platform, has completed a successful integration with the Charles River Investment Management Solution (Charles River...

MarketAxess’s Axess All Prints to offer real-time price transparency in Europe

Fixed income market operator and data provider, MarketAxess, has launched Axess All Prints, a real-time transacted price service for the most actively traded fixed...

Ediphy Analytics announces ten financial institutions working with its consolidated tape

Data analytics provider Ediphy Analytics is now working with over ten global financial institutions, including Norges Bank Investment Management, Deutsche Bank, Citadel Securities and...

Union Investment imposes a purchase ban on Russian state bonds and sanctioned companies

Union Investment has decided to impose an immediate ban on the purchase of all securities of the Russian state and a number of Russian...

Market reflects grim situation in Ukraine

The invasion of Ukraine on 24 February 2022 by Russia, wedded to subsequent sanctions and travel restrictions have triggered a series of market responses...

Restricting access to derivatives

In 2022 regulation and market activity may see greater adoption of derivatives, but traders need to be cognisant of their limitations. Dan Barnes reports.

Derivatives,...

Women in finance: A fresh start

Roxane Sanguinetti, head of strategy at GHCO talks to Lynn Strongin Dodds about fintechs, ETFs and culture

Working at a start-up can be an adventurous...

Swedish regulator FinansInspektionen flags corporate bond markets for review in 2022

Swedish capital markets regulator, FinansInspektionen (FI), has published its priorities for 2022, including a review on the bond markets and fund holdings of corporate...