FILS USA 2022: Behind the scenes

The buzz at FILS this year reflects the three-year hiatus from in-person events – and the amount of change that has occurred since then....

FILS USA 2022: Following a difficult start to the year…

The Fixed Income Leaders’ Summit (FILS) USA will this year begin after a period of difficult liquidity in bond markets.

MarketAxess data showed trading volumes...

Alison Hollingshead joins Jupiter AM

Alison Hollingshead has joined Jupiter Asset Management as chief operating officer for investment management.

“I am delighted to be starting my new role as COO,...

Daniel Fields named as TP ICAP’s new CEO of Global Broking division

TP ICAP, the interdealer broker, electronic trading, data and market infrastructure, has appointed Daniel Fields as CEO of its Global Broking division, reporting directly...

On The DESK: What it takes to build a multi-asset trading team

Since becoming global head of trading at Schroders, Gregg Dalley has helped his teams become a single, multi-asset trading unit.

The DESK: What is your team’s...

Seth Johnson joins LedgerEdge in senior advisory role

Bond-trading platform, LedgerEdge, has appointed Seth Johnson to the firm as a senior advisor. Johnson will focus on commercial plan and growth, including business...

APG selects FlexTrade for multi-asset execution

APG Asset Management (APG) has selected FlexTrade’s execution management platform, FlexTRADER EMS, to consolidate and streamline its multi-asset execution management capabilities.

APG, headquartered in the...

Coalition Greenwich: Buy-side desk budgets hit US$2 million per year

The average buy-side trading desk budget is just over $2 million annually, inclusive of both technology and compensation, with roughly one-third allocated to technology...

SGX CDP live with Marketnode DLT direct-to-depository service for bond issuers

Singapore Exchange’s Central Depository (SGX CDP) has made a blockchain-enabled bond issuance platform available to market participants. Developed by Marketnode, an SGX Group-Temasek digital...

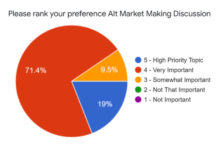

Credit Market Structure Alliance: The real market agenda

The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been...