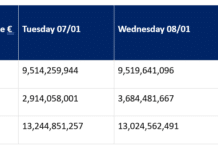

Europe’s government bond market hits electronic ceiling

Electronification of rates in Europe could significantly enhance liquidity and boost trading. David Wigan investigates.

Electronic trading of European government bonds may face a natural...

Izzy Conlin & Bryan Knapp: On cutting through complexity

There is nothing simple about the task facing BlackRock’s dealing teams, who trade for some of the world’s largest fixed income positions. For Izzy...

Rates: The risk of weighting sovereign debt

By David Wigan.

Sweden’s sovereign move has fired a risk weight debate. David Wigan reports.

One of the lessons of recent European economic history is that...

Derivatives: Buying the benchmark

By Fred Maple.

As ownership of fixed income indexes changes, buy-side traders are cautious of the impact. Fred Maple reports.

Three major purchases of fixed income...

The DESK BENCHmark 2017: Mid-sized buy-side have diverse trading

Mid-sized asset managers champion electronic trading - The DESK’s BENCHmark research has found mid-sized firms use electronic trading and a wider range of brokers than...

Securities financing: SFTR threatens smaller players

By Lynn Strongin Dodds.

The delay to the regulation gives market participants more breathing room but they should not get too comfortable. Lynn Strongin Dodds looks...

Bloomberg cracks?

By Josh Weinberger & Dan Barnes.

The famously holistic service has broken out the Instant Bloomberg chat function for non-terminal users, delivering what looks like...

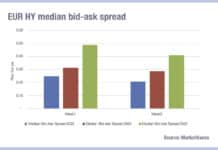

Credit: The liquid, green bond sea

By Dan Barnes.

Green bonds issuance is booming and investor appetite growing, making access to markets increasingly important.

The size of the green bond market reached...

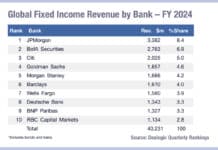

Editorial: Dealer consortium or dealer cartel?

A class-action lawsuit case alleging cartel behaviour by six prime brokers who “vacuum up 60% or more of the revenue generated by stock loan...

Is the price right?

Transparent assessment of bond prices is a cornerstone of trust between investment managers and end investors. Chris Hall investigates.

Pricing in fixed income markets is...