On the DESK : Vincenzo Vedda : DWS

Heading into a stormy 2019, traders need both confidence and evidence to achieve their goals.

What do you think a bond trader in 2018 needs...

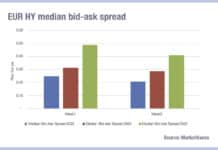

Credit : Falling through the gaps

Asset managers fight for high-touch coverage

Relationship management between buy- and sell-side firms is more necessary than ever, as the push to electronic trading risks...

Derivatives : Migrating benchmarks : Dan Barnes

LIBOR: WHEN TO JUMP ON THE SOFR

The transition from the London Interbank Offered Rate (LIBOR) to overnight indexed swap rates is moving, but when...

Industry viewpoint : MTS

Work smarter with MTS Auto Execution – trade automation at your fingertips

Paul O’Brien, Senior Product Manager at MTS Markets

Automation has become so imbedded in our everyday...

Lead : Best execution : Dan Barnes

The best execution conundrum

Market structure, risk trading and the nature of time-limited instruments make reporting of best execution for bonds a challenge. Dan Barnes...

Rates : Fully automatic? : Dan Barnes

Market volatility may shift rates back to voice in 2019

If predicted volatility pushes firms towards voice trading next year, rates traders will suffer from...

Technology : Trader engagement : Dan Barnes

Helping traders to think like engineers

The gap between the technology a trading team wants and the technology it gets is often wide; helping them...

Securities Financing : US repo : Lynn Strongin Dodds

T-Bills swamp the market but repo stays afloat

Lynn Strongin Dodds looks at the US repo market and how it is staying liquid.

Views are divided...

On the DESK : Dwayne Middleton : Morgan Stanley

The modern trader needs an all-rounder mentality, considerable flexibility and the power to be a decision maker.

Dwayne Middleton is head of US fixed income...

Credit : Back for good : David Wigan

Cautious optimism on Dodd Frank roll-back.

The US regulatory response to the financial crisis has shifted trading risk from sell-side to buy-side desks, making reform welcome....