Data’s weakness in March crisis accelerates calls for European tape

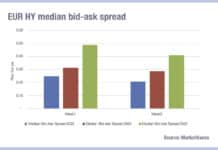

Where European bond market infrastructure has lagged behind US, traders – and therefore investors – have suffered.

From a promised age of enlightenment, many traders...

Under the skin of new US crossing rules

Crossing trades internally would have saved US investors many millions in March. Dan Barnes reports.

US market regulator the Securities and Exchange Commission (SEC) is...

Lynn Challenger: Riding out historical volatility

UBS AM’s trading team is designed to engage by choice, not necessity, allowing it to move in heavily directional markets for the advantage of...

E-trading ‘outpaced’ voice for some traders in liquidity crisis

The market has evolved valuable alternatives to traditional dealer liquidity.

Electronic trading was tested in the March 2020 sell-off, and it held up well. But, most...

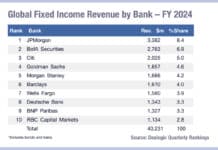

How Fed bond buying is impacting markets

The Federal Reserve Bank of New York is hoovering up assets in order to support corporate borrowing in the US, and subsequently creating some...

Buy side wants new tools in primary market tsunami

Several buy-side traders report new primary bond market tools could come online this year in the US, with dealer consortium DirectBooks expected to step...

Liontrust – The trading team built for growth

Matt McLoughlin, partner and head of trading at Liontrust Asset Management, explains why expanding trading capabilities to match AUM and asset class growth needs...

The DESK’s Trading Intentions Survey 2020 : Unpicking the buy-side workflow

We reveal the buy side’s use of platforms for pre-trade data, executing orders in the market and trading venues.

Trading Intentions Survey highlights

Bloomberg has...

EMSs connect the dots in bond trading

Increased integration between venues and trading tools could herald far greater automation.

Moving a fixed income order from a portfolio manager to a counterparty is becoming...

Europe’s liquidity rules are holding up… for now

New guidance on fund liquidity has followed redemption concerns in European equity and bond funds, writes Lynn Strongin-Dodds.

The risk that funds are unable to...