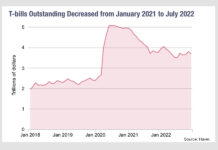

Treasury bill supply and ON RRP investment

By Gara Afonso, Marco Cipriani, Catherine Huang, Gabriele La Spada, and Sergio Olivas.

Take-up at the Federal Reserve’s Overnight Reverse Repo Facility (ON RRP) increased...

Pacific Western and Banc of California merge, sell US$1.9bn in bonds, munis and treasuries

Banc of California has today completed its merger with PacWest Bancorp, with both firms shedding billions of dollars’ worth of agency commercial mortgage-backed securities,...

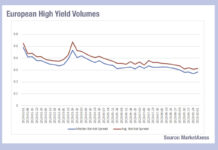

Can you guess which market has seen the greatest fall in bid-ask spreads, year-to-date?

Two weeks ago, we asked what was crushing the US investment grade (IG) market’s bid-ask spread. However there has been an even greater reduction...

BIS: Cut your trading costs in half by cosying up to dealers

A new working paper, written by the Monetary and Economic Department of the Bank of International Settlements, has found that dealer relationships are crucial...

Bank of England launches SWES test for bond markets

The Bank of England (BoE) has published the latest phase of the System-wide Exploratory Scenario (SWES) with bank and non-bank participants provided a hypothetical...

This! Is! What! Liquidity! Looks! Like!

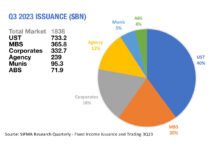

In the past quarter, the average daily notional traded for US Treasuries was 99.5% of the total value of securities issued in the same...

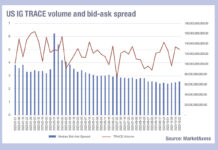

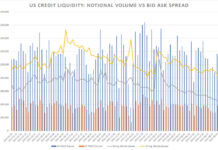

What is crushing the bid-ask spread in US IG?

The bid-ask spread in US investment grade credit has been falling this year, regardless of the trading volume activity.

Notional traded in the US...

Europe sees big drops in implied liquidity costs

Since the start of 2023, European corporate bonds have seen a greater drop in bid-ask spreads than has been seen in their US investment...

Debt, Outstanding!

The rising level of outstanding debt in the US markets is remarkable – it hit 144% of gross domestic product (GDP) in 2022 according...

BOB Secondary: US Credit has never had it so good

Liquidity in US credit has improved significantly over the past year, with bid-ask spreads lower than any point in 2022, according to MarketAxess’s CP+...