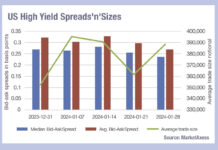

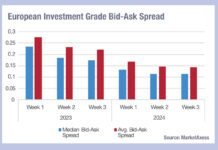

Tighter spreads, bigger trades

Credit markets have largely seen tightening bid-ask spreads since the start of the year on both sides of the Atlantic – some segments more...

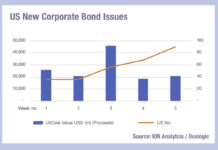

The big issue

Corporate bond issuance has boomed at the start of 2024, at a point when rates are peaking. They may not be that high in...

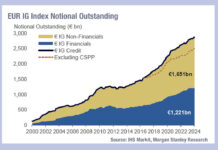

Supply, gross

Debt markets are looking bloated in Europe, with a 33% increase in European non-financial investment grade issuance year-on-year (YoY) year-to-date and a 31% increase...

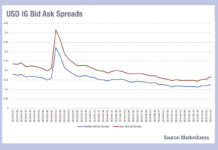

What is behind the falling cost of IG liquidity?

The bid-ask spreads in credit trading across the Europe and US have fallen dramatically in the first three weeks of 2024, relative to the...

Forging new paths in fintech

MarketAxess’s head of business development for post-trade, Camille McKelvey discusses her personal journey, and the path to leadership for women in capital markets.

Camille McKelvey is...

A flying start to 2024 in European bonds may punish traders

The new year has seen a flying start in bond issuance in Europe, with a strong start relative to recent years driving €8.6 billion...

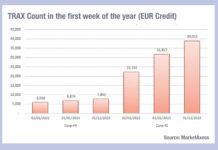

Does this year start with the smallest trades ever?

Trading activity in European bond markets at the start of 2024 has had the highest trade count of the past three years by some...

Betting the house

Mortgage origination in the US is predicted by the Mortgage Bankers Association (MBA) to rise significantly across 2024-25, yet trading of securitised mortgages still...

Review of 2023 Trading: Trade sizes falling – in parts…

Looking back at this year’s trading activity, through analysis of MarketAxess Trax data and TRACE for US markets, we can see clear patterns emerging...

The beginning of the end (of liquidity provision)?

Bid ask spreads are widening in US investment grade credit, according to MarketAxess’s CP+ data, which may signal the traditional end-of-year withdrawal of dealer...