The good news on high yield trading

Two weeks ago we noted that high yield markets have seen trade sizes increase since the start of the year, running counter to the...

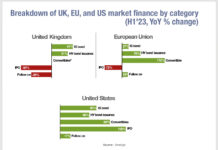

Issuance of debt increasingly financing UK companies

Analysis of corporate financing across European, UK and US markets by the Association of Financial Markets in Europe (AFME) has found that over the...

High Yield issuance is taking off

Comparing corporate bond issuance volumes for 2023 and 2024, we can see that the pattern is frequently a high start to the year, with...

Control is the best defence

By Chris Roberts | 29 May 2024

With a growing level of scrutiny coming from European Regulatory bodies about the quality of data reporting, firms...

High Yield did not get the ‘trade size’ memo

High yield trade sizes are continuing to rise in 2024, and its bonds continue to show signs of increasingly manual trading. As bond markets...

Emerging market bonds issuance and returns grow

This week we examine the very directional movements of emerging markets (EM) assets under management (AUM), due to investment flows and growing issuance. With...

What EM trade sizes tell us about market evolution

While issuance of emerging markets bonds beat the same period in 2023 by a third, secondary trading is far more choppy, with a stepped...

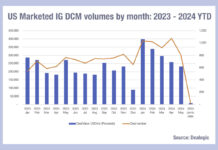

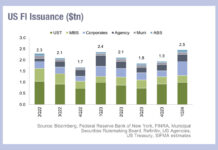

Shielding from exploding issuance

US fixed income markets saw issuance in Q1 2024 hit US$2.5 trillion according to the Securities Industry and Financial Markets Association (SIFMA), an increase...

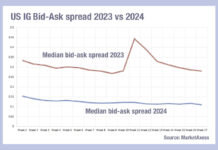

A great vintage for bid-ask spreads

This year’s bid-ask spreads in US investment grade are half those of last year, prompting much celebration on the buy side, but clearly having...

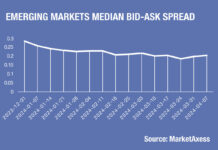

Bid-ask spreads drop 25% on average in many markets

The cost of liquidity as measured by the bid-ask spread in bond trading has fallen by approximately 25% since the start of the year,...