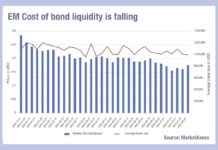

Falling emerging market liquidity costs reversed with Fed concerns

Traders in hard currency fixed income emerging markets have seen a decline in the costs of liquidity this year, according to data from MarketAxess’s...

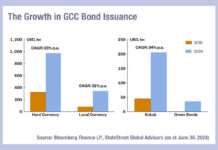

Key trends in emerging markets debt issuance in 2024

Emerging market debt is seeing the effects of government reforms in both democracies and autocracies this year, with stability being the watch word for...

MarketAxess: Portfolio Trading for Tax-Exempt Munis is now live

Portfolio Trading for Tax-Exempt Munis is here!

Optimize your list trading for large or customized portfolios. With the ability to negotiate on individual line...

Case study: Russell Investments in Search of Liquidity – Open Trading

As a top provider of Execution and Transition Management Service, Russell Investments understands the importance of leveraging cutting-edge tools for best execution.

Read more...

US credit issuance tailing off over summer?

June 2024 has seen US corporate bond issuance levels only slightly higher than those seen in June 2023, after record levels at the start...

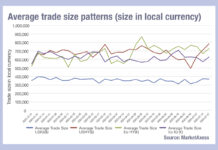

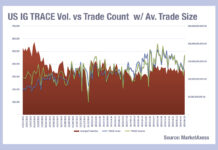

Not average: Trade sizes in 2024

Looking at the average trade sizes for high yield and investment grade bonds, across Europe and the US in 2024, we can see considerable...

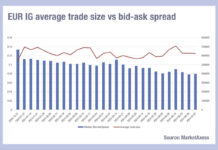

Europe’s incongruous drop in IG bid-ask spreads

European investment grade (IG) credit traders will have seen average bid-ask spreads declining since April, with the median average (typically about €0.03 cents lower...

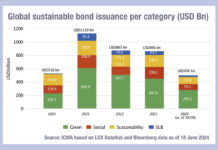

Sustainable bond issuance now 12% of total market

A report co-authored by Nicholas Pfaff, Valérie Guillaumin, Simone Utermarck, Ozgur Altun and Stanislav Egorov of the International Capital Markets Association (ICMA), has found...

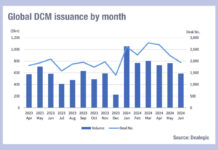

Issuance in double figure growth everywhere (ex-Japan!)

The debt markets have been booming globally in the first half of 2024, according to Dealogic data, with Middle East and Africa seeing issuance...

Upping strike rate and strength in US IG

We often hear ‘nothing really changes’ in relation to capital markets so it is good to have an insight into real progress, courtesy of...