EMIR refit: get ahead of upcoming changes

By Joanne Salkeld at MarketAxess

The European Commission's regulatory fitness and performance programme (REFIT) is aimed at simplifying EU legislation and reducing any unnecessary regulatory...

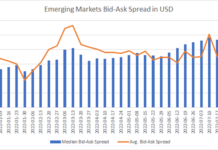

Emerging Markets Focus Part 2: Illiquidity in numbers

When investment flows are heavily directional it can make trading more challenging, as most investment firms are selling into a downward market or buying...

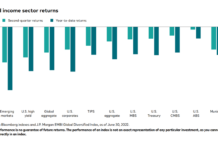

Emerging Markets Focus Part 1: What the flows mean for traders

Fixed income sector investments have proven worst for emerging markets funds year to date, according to data from JP Morgan and Bloomberg indices, driving...

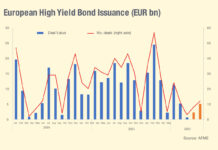

S&P Global: European bonds slump to lowest first-half volume since financial crisis

By Thomas Beeston

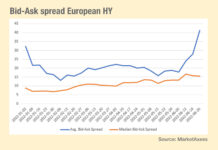

European high-yield bond issuance is set for the lowest first-half total since the global financial crisis, as volatile interest rates and fears...

Splinters of a market

While liquidity in US investment grade (IG) markets has been holding up relatively well, MarketAxess data shows us that the past month has seen...

Analyzing chair Gensler’s comments on TRACE reporting

By Julien Alexandre & Grant Lowensohn

Highlights

The SEC chair recently announced the SEC was considering reducing the reporting window for US corporate bond transactions to...

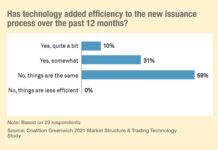

New issuance process unchanged for 59% of traders despite electronification

New research from analyst firm, Coalition Greenwich, has found that 59% of traders are still waiting to see an improvement in the new issue...

Bid-ask spread betting in credit

Betting how bid-ask spreads will move this year has been made more challenging by a dislocation between the mean average and the median bid-ask...

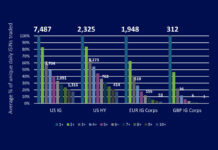

Comparing Corporate Bond Liquidity Across Regions

By Grant Lowensohn and Hidde Verholt.

Highlights

The US corporate bond market offers a significantly greater number of ISINs with high daily trade counts than other...

AFME update: European HY bond issuance fell nearly 60% year-on-year

A new report by AFME found that the primary high yield bond market decelerated significantly in Europe at the start of this year.

High yield...