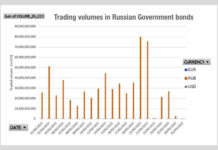

A very clear contrast in trading volumes as sanctions bite

The second chart this week shows trading in Russian government bonds which fell off a cliff at the start of March, triggered by an...

The effect of war on pricing and spreads is widening

The economic effect of the Russian invasion of Ukraine needs to be put in context next to the human tragedy, but data is showing...

Emerging markets’ big issues in 2022

According to analysis by CreditSights, there has been a negative total return for credit in emerging markets with the exception of Gulf Cooperation Council...

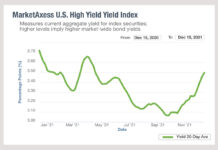

Analysis of US yields in 2021 and anticipation for next year

Yields for US high yield bonds have turned a corner, according to MarketAxess data, following a drop from 3.65% in April down to 3.065%...

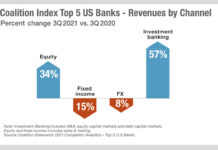

What banks’ primary success can tell us about their priorities in 2022

When looking at the revenues of investment banks in Q3 2021, using Greenwich Coalition data, we can see that secondary market trading in fixed...

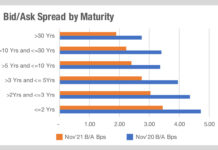

The impact of trading long-dated bonds

Faced with the prospect of climbing rates, some investors will be looking to switch out of lower coupon bonds to capture higher returns. However,...

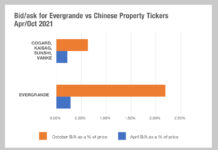

China Focus: The secondary effect of defaults

The bid-ask spread for bonds in China’ property market has expanded by 300% this year, although even more so for Evergrande which increased by...

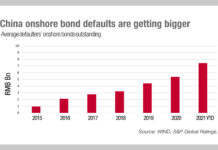

China focus: The outstanding debt of defaulters

Concern around issuer defaults in China is clearly based upon good evidence; our chart this week from S&P Global Ratings shows the annual growth...

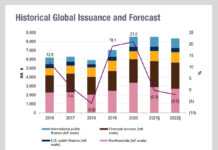

2022: Big primary, smaller secondary?

Despite the expectation of rising rates across markets, S&P Global Ratings Research are predicting that issuance of new bonds across markets will not see...

Prioritising investment on the high yield trading desk

When we look at the priorities of trading desks in developing more automated tools, we can consider the longer term market trends as a...