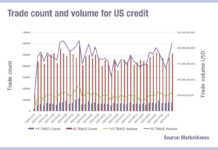

Trade size disparity in US credit speaks volumes about balance sheet

Analysis of trading activity in the US corporate bond market shows that investment grade (IG) bonds are seeing greater moves towards larger order sizes...

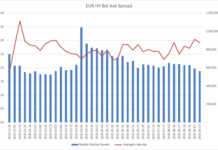

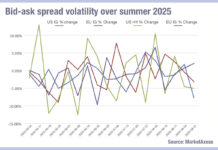

Bid-ask spreads expanding in European credit

European credit traders have seen bid-ask spreads expand over the past two weeks, however this follows a notable tightening since summer, according to data...

Analysing concern around Japan’s government bond issuance and interdealer inefficiency

The appointment of Liberal Democratic Party (LDP) leader Sanae Takaichi as the country’s first female prime minister has drawn comparisons with two of the...

September takes the biscuit in new issues

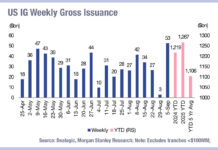

September did not disappoint in its delivery of high issuance in the US for corporate bonds across both investment grade and high yield. Monthly...

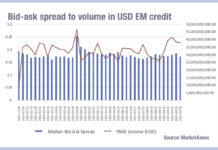

What’s up EM?

Emerging market volumes have jumped in September, hitting levels not seen since April 2025, when the US trade taxes on imported goods from every...

Issuance up in lower rated debt

Analysis by Morgan Stanley’s team has found that, despite the slowing down of bond issuance globally in August, the higher levels of activity in...

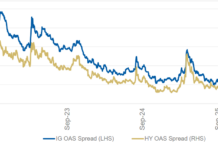

High yield market makers comfortable with risk

European bond traders are seeing average trade sizes expanding in September while bid ask spreads lower to the bottom end of their range as...

September explodes with new corporate bonds

Traders report expectations of outsized corporate bond issuance, with up to US$60 billion expected in US investment grade issuance, and reached $53 billion last...

Price volatility in credit

We saw a big drop in average bid-ask spreads (>7%) for US investment grade (IG) last week, possibly a response to the massive levels...

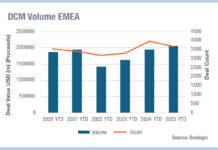

European debt is standing up for primary markets

Global debt capital market (DCM) deal count year-to-date is down 5% year on year, according to Dealogic data. However, the local market pictures present...