Unlocking Liquidity for the U.S. Treasury Markets

Unlocking Liquidity for the U.S. Treasury Markets

By MarketAxess | 22 November 2022

Advocating for all-to-all trading has always been the MarketAxess way, but lately, it...

The vicious circle of trust and liquidity

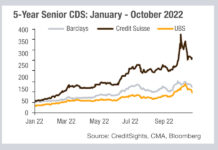

Looking at data provided by CreditSights, we can see the extent of lenders’ concern about Credit Suisse this year. The cost of insuring Credit...

Breaking blocks

Electronic trading is certainly on a growth spurt – Coalition Greenwich reports e-trading was 46% volume across all assets in 2021 – but this...

Month-end activity in alternative protocols

By Misha Girshfeld, Research Specialist and Grant Lowensohn, Senior Research Analyst at MarketAxess. 25 October, 2022

Highlights

We have seen an average increase of about 11%...

Barnes on Bonds: Secondary Gilt Trip

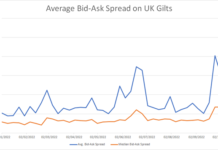

To look at the whipsaw effect of the UK’s 23 September mini-budget on secondary UK bond trading, we have taken data from MarketAxess TraX,...

Barnes on Bonds: Primary Gilt Trip

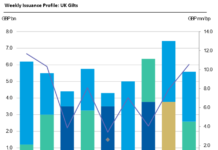

To see political risk writ large in financial markets, look no further than the UK. While Rishi Sunak has won the race to be...

A tale of two metrics – US IG corporate bond market liquidity in 2022

By Julien Alexandre, 12 October 2022

Corporate Bond Market Distress Index

The NY Fed recently launched the Corporate Bond Market Distress Index and backfilled it all...

Bringing innovation and liquidity to the US Treasuries market

Earlier this month, PIMCO, one of the world’s largest fixed income asset managers, published their view on how to improve the functioning of the US...

What volatility looks like

Understanding how challenging the European markets have been to trade this year is far clearer when looking at the numbers. According to MarketAxess TraX...

If you go down to the woods today…

The bond market is bearish at a historical level according to analysis by BofA Securities, with high yield down -16.7%, investment grade down -19.3%,...