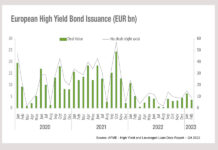

Rising rates hit high yield availability

Despite some optimistic outlooks on bond issuance in 2023, high yield bonds are clearly seeing a decline in Europe, based on data from the...

Are issuers predicting a 6% Fed Funds rate?

Bond issuance has continued to beat expectations in February 2023. Last month saw 774 investment grade bonds issued globally, for a notional value of...

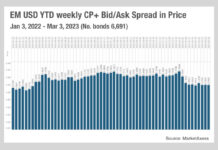

Emerging markets’ uneasy calm

Bid-ask spreads for fixed income trading in emerging markets have stabilised after a tumultuous year in 2022, according to TraX data, triggered by the...

Research: ETFs worsen fixed income liquidity in a crisis

An academic paper has argued that fixed income exchange traded funds (ETFs) “improve bond liquidity in general, but worsen it in periods of large...

The cost of European liquidity is falling, does e-trading beckon?

Good news for buy-side traders in European credit markets. Looking at MarketAxess Trax, which tracks trading across multiple markets and counterparties, bid-ask spreads are...

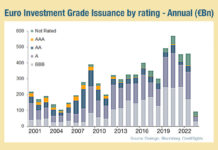

Europe’s record IG credit issuance could boost electronic trading

January was a record month for investment grade bond issuance in Europe, with shorter-dated driving this activity. According to analyst firm CreditSights, shorter maturity...

Portfolio trading breaks into new markets

Emerging markets are adopting PT to add efficiency to liquidity sourcing, writes Matt Walters of MarketAxess.

Portfolio trading has seen a lot of success and...

Can primary markets deflate?

Inflation levels could have a direct impact on volume of work – and therefore operational pressure – on buy-side trading desks.

Managing the process of...

US Credit: Liquidity costs trending down

The bid-ask spread in US high yield trading is falling again having suffered an uptick in December, according to MarketAxess Trax, which tracks trading...

Primary markets start 2023 with top ten hit

Bond issuance for US investment grade on 3 January 2023 was the tenth largest day on record, according to data from Dealogic.

While January is...