What volatility looks like

Understanding how challenging the European markets have been to trade this year is far clearer when looking at the numbers. According to MarketAxess TraX...

If you go down to the woods today…

The bond market is bearish at a historical level according to analysis by BofA Securities, with high yield down -16.7%, investment grade down -19.3%,...

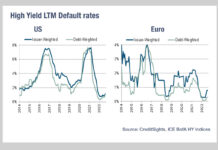

Less distressed debt

The risks of default in high yield credit are one reason cited for reduced sell-side trading activity in the asset class. However, while the...

Is a liquidity crisis brewing in European HY?

Concern around liquidity in Europe’s high yield market has been rising over the past quarter as it is hit by a double whammy, falling...

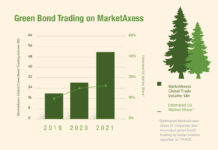

Trading for Trees

In 2019 MarketAxess launched their “Trading for Trees” program, under which five trees are planted by One Tree Planted, a partner charitable organization, for...

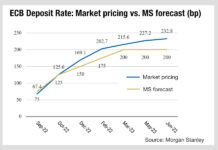

Chart of the week: ECB rates rise expectations

Expectations on the European Central Bank’s appetite to increase its interest rate will have a direct and negative impact on European bond trading which...

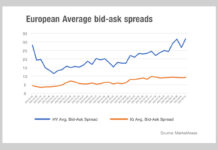

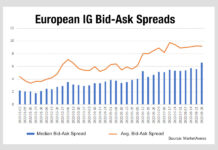

Why are European IG Bid-Ask spreads widening?

Liquidity in the European corporate bond market is becoming more expensive in both high yield (HY) and investment grade (IG) trading. According to MarketAxess...

Case Study

Axess IQTM: The eyes and ears of the market

Over the past twelve months, MarketAxess in partnership with Insigneo rolled out a pilot program to put...

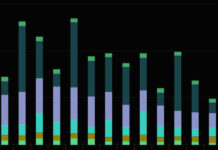

The implication of falling US HY Issuance

Anecdotally, we hear that new issuance of high yield bonds in European markets directly impacted secondary market liquidity. Looking at the latest data from...

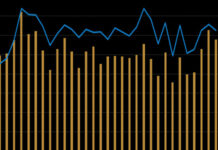

Get US high yield portfolios in order over summer

June looked decidedly challenging for US high yield (HY) trading, as mean bid-ask (BA) spreads dislocated from the median, indicating spikes in BA spreads...