US Credit: Liquidity costs trending down

The bid-ask spread in US high yield trading is falling again having suffered an uptick in December, according to MarketAxess Trax, which tracks trading...

Primary markets start 2023 with top ten hit

Bond issuance for US investment grade on 3 January 2023 was the tenth largest day on record, according to data from Dealogic.

While January is...

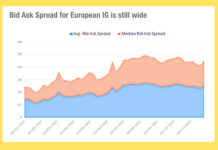

Same trading costs, different year

The new year has seen trading volumes drop back to a similar level as seen in early January 2022, but in European credit, bid-ask...

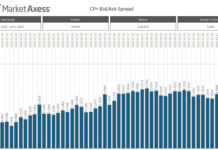

Tradeweb and MarketAxess see credit volumes increase over 25% in December

Market operators MarketAxess and Tradeweb have released their December trading levels, with both seeing a monthly increase of 25% in credit trading average daily...

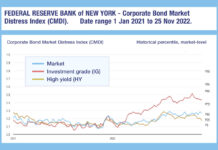

Substantially higher US investment grade stress going into 2023

The Federal Reserve Bank of New York’s Corporate Bond Market Distress Index (CMDI) is closing 2022 with investment grade US bond markets twice as distressed as...

Reviewing 2022: European credit trading costs have doubled

There have been an enormous number of factors shaking up bond trading this year. From fixed income fundamentals like rapidly rising interest rates from...

Analysis: E-trading platforms see gains and losses in corporate bond market battle

Morgan Stanley analysis of the monthly reports from market operators Tradeweb and MarketAxess, has shown wins and losses in market share for both platforms.

Looking...

All I want for Christmas, is trading analytics

Traders would do well to run close analysis over their European trading activity this month, as data from MarketAxess Trax, which tracks trading across...

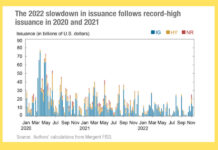

Liberty Street Economics asks: How Is the corporate bond market functioning as rates rise?

The Federal Reserve Bank of New York’s market structure and macro analysts, Liberty Street economics, has examined how corporate bond market functioning has withstood...

Invesco’s 2023 Fixed income outlook: ‘A promising year after a painful selloff’

Invesco has published its outlook for fixed income markets in 2023, noting that valuations now look more attractive, and yields are higher than they...