Implied cost of liquidity falling, with US high yield an exception

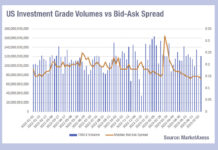

Volumes in the corporate bond markets have been picking back up, relative to bid-ask spreads, indicating an improving liquidity picture across the US and...

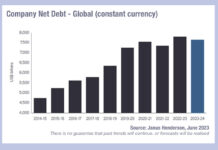

Issuance pushes outstanding global debt up 6.2%

Companies around the world took on US$456 billion of net new debt in 2022/23, as of 31 March 2023, pushing the outstanding total up...

ICMA fills in the blanks on MiFID II agreement

A new article written by the regulatory team at the International Capital Markets Association (ICMA), has shed light on details in the agreed text...

EM stabilising could encourage market makers

Emerging market activity has seen a reduction in volatility in the first half of the year, with both volumes and pricing levels falling slightly,...

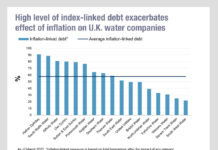

Examining the (Thames) Water fall

In 2013 when markets still looked precarious amid the fallout from the financial crisis, utilities were a good investment.

With a near cast-iron cashflow...

Liquidity costs ticking up as the heat rises

Summer is seeing the cost of trading in fixed income markets begin to tick up again, as bid ask spreads begin to widen, according...

Aligning issuance and recession risk

Data from Dealogic is indicating highly variable bond issuance patterns in the US, European Union and UK markets, year-to-date.

This is understandable given the rapidly...

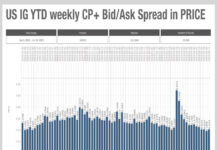

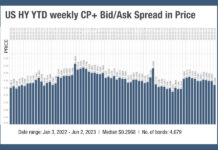

Feeling the credit crunch in high yield trading

Trading costs for high yield bonds have been elevated on both sides of the Atlantic. The US saw a big jump in bid-ask spreads...

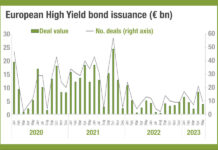

High yield issuance may bounce back

The data for Q1 bond issuance in European high yield (HY) markets shows that it fell 22.7% according to the Association for Financial Markets...

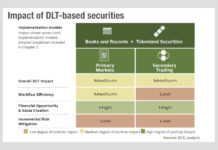

DLT – What is the value in primary markets?

A recent study prepared on behalf of the Global Financial Markets Association (GFMA) by Boston Consulting Group, Cravath, Swaine, and Moore LLP, and Clifford...