Hold me now!

“Hold me now,

Whoa, warm my heart,

Stay with me!”

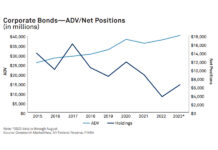

This Thompson Twins’ classic could be sung by corporate bonds to the sell-side community, who saw their...

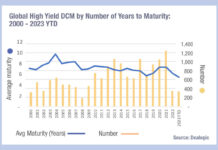

What do shorter durations imply for trading?

Data from Dealogic shows that the average maturity for newly issued bonds has been falling in 2023 relative to recent years, with the current...

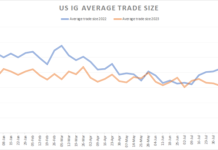

Have US IG trades hit their smallest size this year?

The fires of summer are being replaced by the floods of autumn, but in the bond markets a gentler and more positive outcome is...

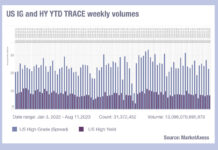

Are average trade sizes really falling in the US?

Earlier this year we noted that average trade sizes were down considerably on 2022, but being wary of mean reversion, we wanted to revisit...

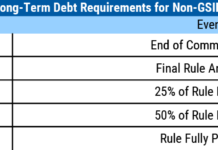

FDIC drive to issue US bank debt

Banks in the US have been asked by Government agencies to issue new debt to support their stability under a new proposal by the...

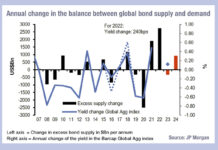

Rising rates but falling demand

Analysis by JP Morgan’s Global Markets Strategy team, Nikos Panigirtzoglou, Mika Inkinen and Mayur Yeole has cast an interesting light on the prospects for...

Seize the opportunity to apply AI in quieter bond markets

Secondary credit trading is seeing lower volumes as expected in the summer months, whilst bid-ask spreads have plateaued across Europe and the US markets,...

Local currency emerging market trading grows at MarketAxess

MarketAxess, the operator of an electronic trading platform for fixed-income securities, has seen a rise in volumes of local currency bond trading in emerging...

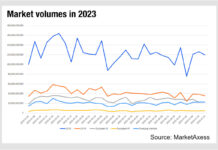

The summer lull barely touches emerging markets

Trading volumes in fixed income markets typically start the year high and gradually fall, matching issuance and refinancing patterns along with investment allocation decisions....

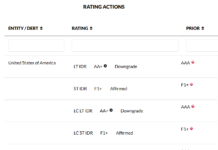

The US: Too big to Fitch?

Ratings agency Fitch has downgraded the United States’ long-term credit ratings to AA+ from AAA and removed the rating ‘Watch Negative’ stating “ reflects...