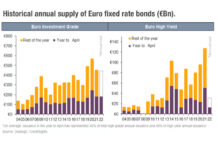

Withering supply of European high yield

Comparing the ‘year-to-April’ data across years, 2022’s high yield issuance looks more like the post-financial crisis period than most years in between.

Data from CreditSights...

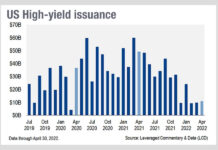

How does the collapse of refinancing affect bond trading?

It costs more to borrow money in the US right now, than it has for a long time. Even more so for companies in...

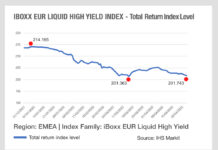

Value and issuance in European credit

Outflows in European bond funds are following a drop in the relative value of European credit, as shown in data from the IHS Markit...

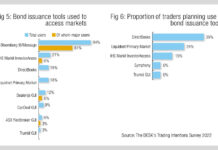

Will primary market tools fragment new issuance instead of standardising it?

Research by The DESK has found that buy-side traders have adopted a range of primary market tools to help them increase their efficiency at...

How the effects of war are spreading in Asia

The war in Ukraine outside of Europe is, from a capital markets perspective, driving a ‘risk-off’ attitude across issuers, buy-side and sell-side firms. As...

The effect of war on pricing and spreads is widening

The economic effect of the Russian invasion of Ukraine needs to be put in context next to the human tragedy, but data is showing...

Emerging markets’ big issues in 2022

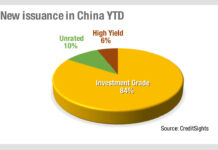

According to analysis by CreditSights, there has been a negative total return for credit in emerging markets with the exception of Gulf Cooperation Council...

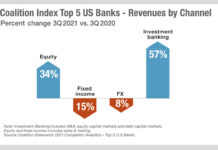

What banks’ primary success can tell us about their priorities in 2022

When looking at the revenues of investment banks in Q3 2021, using Greenwich Coalition data, we can see that secondary market trading in fixed...

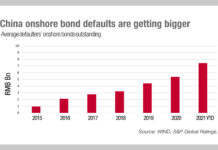

China focus: The outstanding debt of defaulters

Concern around issuer defaults in China is clearly based upon good evidence; our chart this week from S&P Global Ratings shows the annual growth...

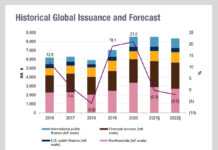

2022: Big primary, smaller secondary?

Despite the expectation of rising rates across markets, S&P Global Ratings Research are predicting that issuance of new bonds across markets will not see...