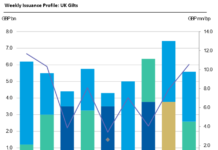

Barnes on Bonds: Primary Gilt Trip

To see political risk writ large in financial markets, look no further than the UK. While Rishi Sunak has won the race to be...

If you go down to the woods today…

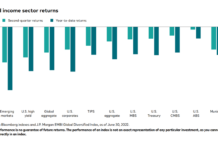

The bond market is bearish at a historical level according to analysis by BofA Securities, with high yield down -16.7%, investment grade down -19.3%,...

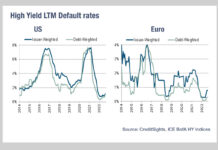

Less distressed debt

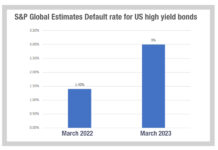

The risks of default in high yield credit are one reason cited for reduced sell-side trading activity in the asset class. However, while the...

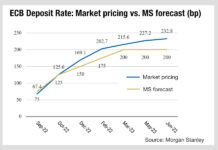

Chart of the week: ECB rates rise expectations

Expectations on the European Central Bank’s appetite to increase its interest rate will have a direct and negative impact on European bond trading which...

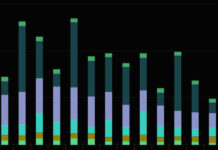

The implication of falling US HY Issuance

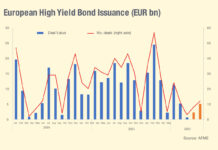

Anecdotally, we hear that new issuance of high yield bonds in European markets directly impacted secondary market liquidity. Looking at the latest data from...

Emerging Markets Focus Part 1: What the flows mean for traders

Fixed income sector investments have proven worst for emerging markets funds year to date, according to data from JP Morgan and Bloomberg indices, driving...

S&P Global: European bonds slump to lowest first-half volume since financial crisis

By Thomas Beeston

European high-yield bond issuance is set for the lowest first-half total since the global financial crisis, as volatile interest rates and fears...

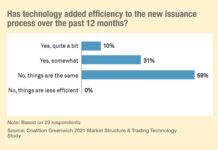

New issuance process unchanged for 59% of traders despite electronification

New research from analyst firm, Coalition Greenwich, has found that 59% of traders are still waiting to see an improvement in the new issue...

AFME update: European HY bond issuance fell nearly 60% year-on-year

A new report by AFME found that the primary high yield bond market decelerated significantly in Europe at the start of this year.

High yield...

The enduring popularity of ‘Don’t Panic’

The phrase ‘Don’t Panic’ crops up frequently in comic fiction, notably in Douglas Adams’ book ‘Hitchhiker’s Guide to the Galaxy’ and in 1970’s British...