Betting the house

Mortgage origination in the US is predicted by the Mortgage Bankers Association (MBA) to rise significantly across 2024-25, yet trading of securitised mortgages still...

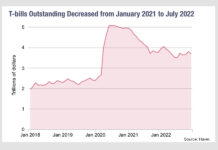

Treasury bill supply and ON RRP investment

By Gara Afonso, Marco Cipriani, Catherine Huang, Gabriele La Spada, and Sergio Olivas.

Take-up at the Federal Reserve’s Overnight Reverse Repo Facility (ON RRP) increased...

BIS: Cut your trading costs in half by cosying up to dealers

A new working paper, written by the Monetary and Economic Department of the Bank of International Settlements, has found that dealer relationships are crucial...

This! Is! What! Liquidity! Looks! Like!

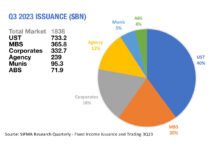

In the past quarter, the average daily notional traded for US Treasuries was 99.5% of the total value of securities issued in the same...

Debt, Outstanding!

The rising level of outstanding debt in the US markets is remarkable – it hit 144% of gross domestic product (GDP) in 2022 according...

Hold me now!

“Hold me now,

Whoa, warm my heart,

Stay with me!”

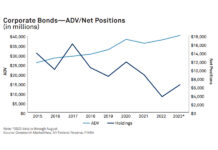

This Thompson Twins’ classic could be sung by corporate bonds to the sell-side community, who saw their...

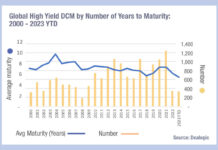

What do shorter durations imply for trading?

Data from Dealogic shows that the average maturity for newly issued bonds has been falling in 2023 relative to recent years, with the current...

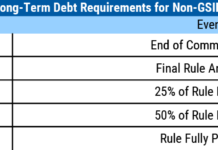

FDIC drive to issue US bank debt

Banks in the US have been asked by Government agencies to issue new debt to support their stability under a new proposal by the...

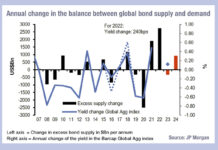

Rising rates but falling demand

Analysis by JP Morgan’s Global Markets Strategy team, Nikos Panigirtzoglou, Mika Inkinen and Mayur Yeole has cast an interesting light on the prospects for...

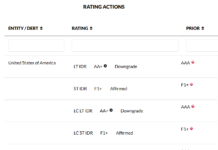

The US: Too big to Fitch?

Ratings agency Fitch has downgraded the United States’ long-term credit ratings to AA+ from AAA and removed the rating ‘Watch Negative’ stating “ reflects...