Shielding from exploding issuance

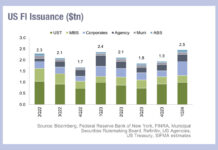

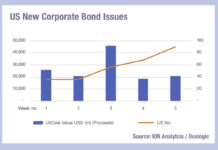

US fixed income markets saw issuance in Q1 2024 hit US$2.5 trillion according to the Securities Industry and Financial Markets Association (SIFMA), an increase...

Great Expectations (on rate cuts)

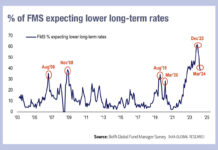

The latest BofA Global Fund Manager Survey has found that 76% of respondents expect two or more Fed cuts in 2024 versus 8% who...

High yield bond issuance relative to liquidity

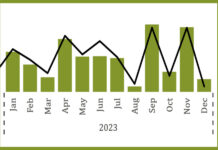

A report by the Association for Financial Markets in Europe (AFME) has found that primary issuance of European high yield (HY) bonds in 2023...

Issuing at the top of the market

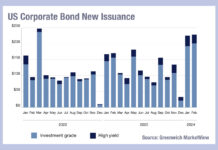

The high levels of bond issuance this year, made at what is widely expected to be peak interest rates, are potentially building up high...

Germany’s rates market comfort

Germany’s government bond market is in rude health, according to the latest analysis of sovereign debt by Andy Hill, director at the International Capital...

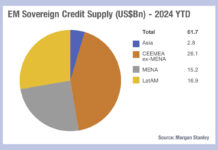

Morgan Stanley: EM issuance in 2024 to outstrip 2023

Assessment from Morgan Stanley has found sovereign hard currency gross issuance is likely to increase to US$164 billion in 2024 due to more open...

The big issue

Corporate bond issuance has boomed at the start of 2024, at a point when rates are peaking. They may not be that high in...

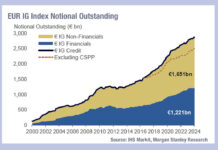

Supply, gross

Debt markets are looking bloated in Europe, with a 33% increase in European non-financial investment grade issuance year-on-year (YoY) year-to-date and a 31% increase...

A flying start to 2024 in European bonds may punish traders

The new year has seen a flying start in bond issuance in Europe, with a strong start relative to recent years driving €8.6 billion...

Betting the house

Mortgage origination in the US is predicted by the Mortgage Bankers Association (MBA) to rise significantly across 2024-25, yet trading of securitised mortgages still...